- The Lira dropped and tested the 200-day SMA vs. the buck.

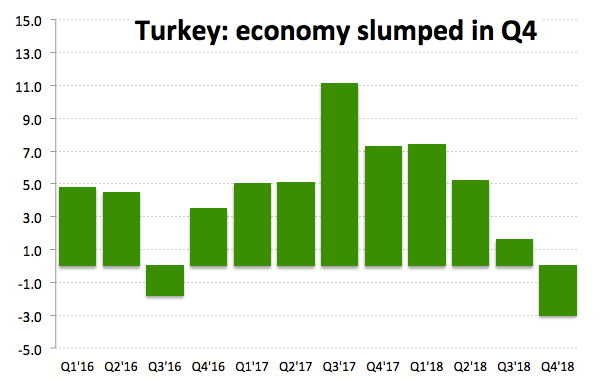

- Turkish GDP contracted 3.0% in Q4 2018.

- Current Account deficit shrunk to $0.81 billion in January.

After a brief test of daily highs just beyond 5.46 the figure, USD/TRY met some sellers and has now receded to sub-5.4400 levels.

USD/TRY higher on GDP figures

TRY derived extra weakness at the beginning of the week after GDP figures showed the economy contracted at an annualized 3.0% during the October-December period, surpassing forecasts for a 2.7% drop and exhibiting the worst performance in almost a decade.

The main reason behind the poor performance of the economy can be found on the crisis that hit the Lira during last year, losing around 30% on the back of the US-Turkey dispute over the pastor A.Brunson, sanctions, and (still) unabated concerns over the conflicting relationship between Erdogan’s government and the central bank (CBRT) led by Governor Cetinkaya.

Still in Turkey, the Current Account deficit shrunk to $0.81 billion in January, more than expected and trimming December’s $1.44 billion deficit.

What to look for around TRY

TRY is entering its sixth consecutive week with losses today, losing ground at a gradual pace since 2019 highs seen at the beginning of February around 5.16 vs. its American peer, as market participants continue to adjust to the potential effects of the continuation of the Fed’s QT on the whole of the EM FX space. In the same line, the persistent deterioration in domestic fundamentals, the permanent conflict between Erdogan’s government and the central bank and potential geopolitical risks should continue to weigh on the currency for the time being. Somehow supporting the Lira, the CBRT still sees risks to the price stability, leaving the current scenario of tight monetary conditions to extend further in the longer term.

USD/TRY key levels

At the moment the pair is gaining 0.18% at 5.4351 facing the next hurdle at 5.4881 (high Mar.8) seconded by 5.5440 (high Jan.9) and finally 5.6371 (2019 high Jan.3). On the downside, a breach of 5.4176 (200-day SMA) would expose 5.3221 (55-day SMA) and then 5.2874 (low Feb.27).