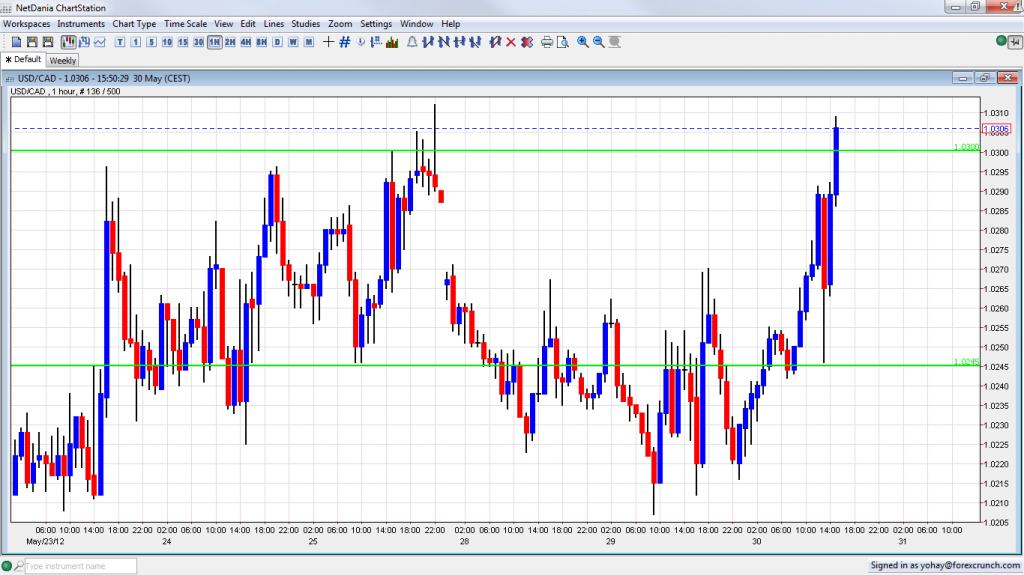

The Canadian dollar resumes its downfall against the US dollar as USD/CAD crosses the closely watched 1.03 line.

This happens as European troubles get worse, especially in Spain.

Spanish yields continue rising after the ECB rejected a Spanish idea to recapitalize banks in an indirect manner via the ECB. A report that the ESM bailout fund could recapitalize banks provided some relief, but this was only temporary.

In Italy, an auction of 10 year bonds resulted in yields topping 6%. This is very high for the euro-zone third largest economy.

If the pair confirms this break, the next level of resistance is pretty far, only 1.0423. USD/CAD already rose above 1.03 very briefly on Friday to hit the highest levels since January. The year-to-date high was 1.0319. Crossing this line would send the pair to levels last seen in December, where 1.0423 was stubborn resistance.

For more on the loonie, see the Canadian dollar forecast.

Also the falling price of oil is weighing on the C$. WTI Crude and Brent are falling. For more about oil, see Trading NRG.