The Bank of Canada did it again. The team led by Stephen Poloz and his colleagues decided to raise interest rates in a decision that was not 100% priced in. In addition, they left an open door to another hike in the near future.

The BOC noted the strong growth in jobs as well as the strong GDP growth. In general, the Canadian economy is doing well and the Ottawa based central bank remains data dependent.

Some had priced in a hike for October and others saw it coming only in 2017. Nevertheless, with a strong GDP read an expected upbeat jobs report on Friday, the BOC has reasons to raise rates.

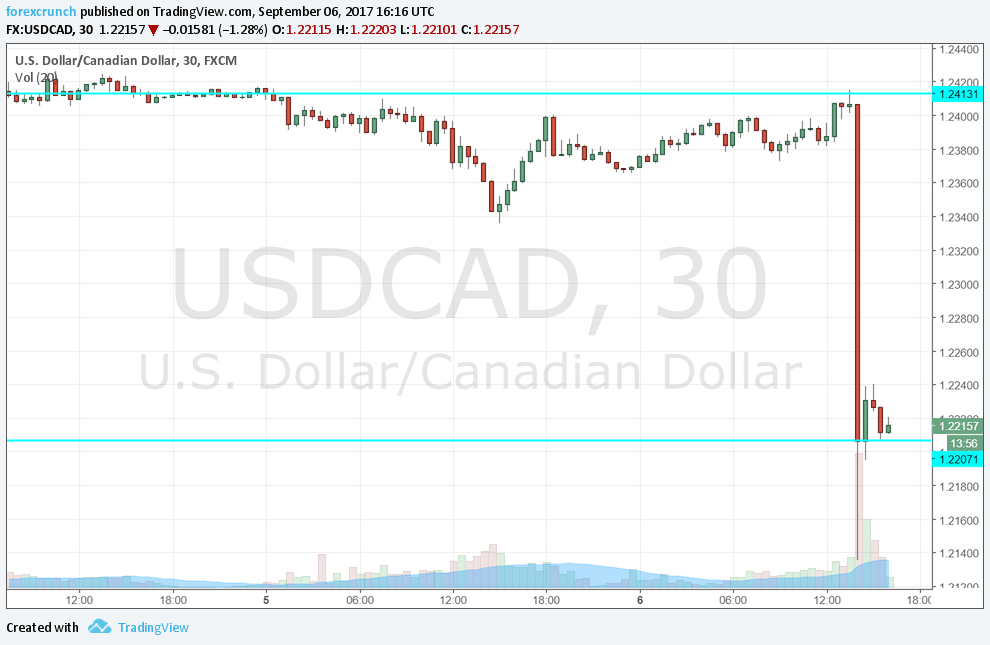

USD/CAD crashed via the air pocket from just under 1.24 to the 1.21 handle before stabilizing at 1.22.

The next levels to watch are 1.2130, which is the lower limit of the air pocket and the very round level of 1.20. In any case, we are at the lowest levels seen since early 2015.

More: USD/CAD has more room to the downside – 2 opinions

Here is the 30-minute chart. We do not see such crashes every day. Will the ECB do the same to EUR/USD?