The Canadian dollar is suffering from the election of Donald Trump as the 45th President of the USA. Is this set to continue? In the meantime, there is no stopping. The pair is already at levels last seen in February.

There are good reasons for this decline, heavily related to Trump’s Triumph:

- Strong dollar: Trump has ambitious plans to cut taxes and spend on basically everything. These plans mean more borrowing from bond markets, higher inflation, and higher interest rates. Everything supports the US dollar. In theory, he could pass these plans in Congress as Republicans have full control. In practice, the same Republicans oppose increasing the debt. Nevertheless, at the moment markets take Trump’s words seriously. The Canadian dollar does not buck the trend, and for good reasons.

- Trade: Trump has vowed to change trade relations, including the NAFTA agreement between the US, Canada, and Mexico. Canada is very dependent on exports to its southern neighbor. Any uncertainty regarding trade relations across the parallel 49th could hurt the Canadian economy, even without any actual change coming, and even if most of the angst is directed at Mexico.

- Oil: Prices of crude oil have fallen. This is partially related to Trump, as a stronger dollar goes hand in hand with lower oil prices, but this is not the only reason. Iran has announced that two new oil fields are now producing oil, and OPEC seems no closer to a real agreement on November 30th. A lower oil price means a weaker Canadian dollar as well.

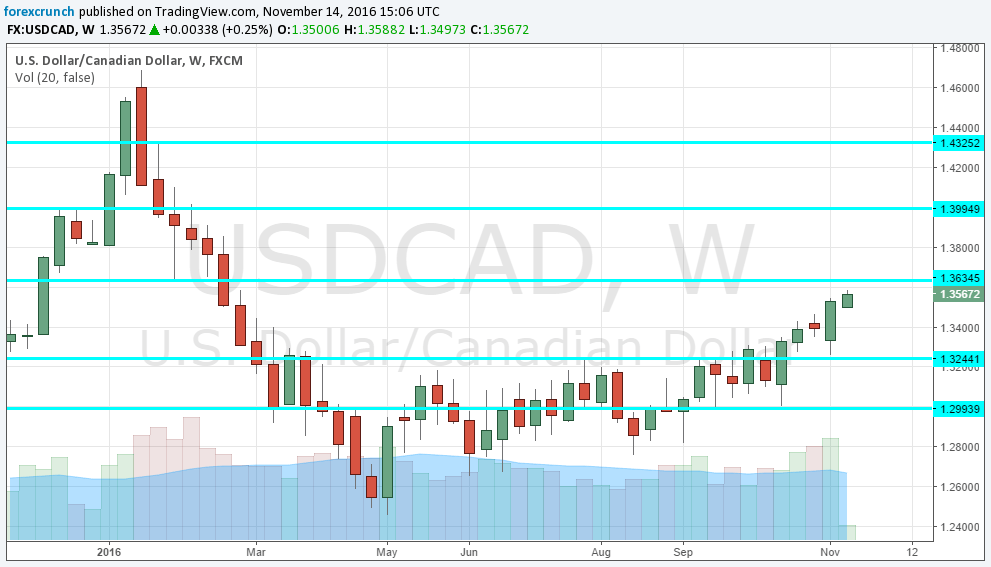

USD/CAD is currently trading at 1.3567, the highest since late February. The next level is 1.3635, a swing low in early February. The round number of 1.40 also worked as resistance in late 2015, making it a strong line as well.

Further, above, 1.4325 is a significant stepping stone towards 1.47, which remains distant. On the downside, we have 1.3245 and 1.30.

More: USD/CAD to 1.39 – CIBC

Here is the Dollar/CAD chart: