The Canadian dollar enjoyed the greenback’s weakness and USD/CAD fell again. GDP, retail sales and inflation figures all promise another busy week. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The loonie certainly received a boost from the announcement of QE4 in the US and the notion that monetary easing will last for a long time. Last week Canada’s manufacturing sales figures for October were released. A nine month drop to -1.4% reflected weakness in major sectors such as motor vehicles and primary metals. Imports had also dropped to a 15-month low in October indicating fiscal problems in the EU and the US are affecting the Canadian market.

Updates: Foreign Securities Purchases dropped slightly to 13.26 billion dollars, but was well above the estimate of 9.85B. Wholesale Sales will be released on Wednesday. USD/CAD is firm, as the pair was trading at 0.9847. Wholesales Sales jumped 0.9%, easily beating the estimate of 0.4%. Retail Sales, a key release, climbed 0.5%, while Core Retail Sales gained 0.7%. The estimates for both consumer indicators stood at 0.2%. USD/CAD is showing very little movement, as the pair was trading at 0.9887.

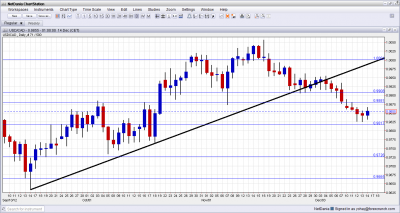

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Foreign Securities Purchases: Monday, 13:30. Foreign net purchases nearly doubled in September to a total of C$13.9 billion ($13.9 billion) from C$7.56 billion in August, amid purchases of C$8.94 billion government bonds and C$1.52 billion of money-market paper. The purchases also included Non-Canadians buying commercial shares.

- Wholesale Sales: Wednesday, 13:30. Canadian wholesale sales dropped for the first time in seven months, down 0.4% in November from a 0.3% rise in the previous month. The unexpected decline surprised analysts forecasted a 0.5% increase. A rise of 0.4% is expected now.

- Retail sales: Thursday, 13:30. Canadian retail sales climbed 0.1% in September from a 0.3% increase in August. Despite it being the third monthly increase, it is lower than the 0.5% increase forecasted by analysts, indicating a slowdown. Meantime, excluding automobiles remained unchanged. Retail sales is expected to gain 0.1% while Core sales is expected to rise 0.2%.

- Inflation data: Friday, 13:30. Canadian inflation was slightly stronger than expected in October, rising 0.2% but still way below the 2.0 target rate set by the BOC. Meanwhile core CPI excluding volatile items rose 0.3%. On a yearly base, consumer price index increased 1.2% in October, while the core inflation rate, edged up 1.3%. The BPC forecasted inflation would reach 1.5% in the fourth quarter. CPI is expected to decline 0.1% while core CPI is predicted to gain 0.1%.

- GDP: Friday, 13:30. Canada’s economy closed a weak third quarter with a flat reading following a 0.1% drop in the previous month, contrary to the 0.1% expansion predicted by analysts. The goods producing sector dropped, as well as Utilities. Following the weak data in the third quarter, the fourth quarter is headed for a lame start. An expansion of 0.1% is forecasted.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/CAD began the week with a drop under the the 0.9880 line (mentioned last week). and it continued lower. The pair found its bottom at 0.9825 before recovering and closing at 0.9855.

Technical lines, from top to bottom:

We start from lower ground this time. 1.02 was the trough of 2009 and remains important since then, working in both directions. Another round number, 1.01, was a trough back in July, and switched to resistance afterwards.

1.0066 was key support before parity. It’s strength during July 2012 was clearly seen and it gave a fight before surrendering. It has a stronger role after capping the pair during November 2012.

The very round number of USD/CAD parity is a clear line of course, and the battle was very clear to see at the beginning of August 2012. 0.9950 provided some support for the pair during November and worked as resistance earlier. Its stubborn behavior as resistance in December proved its strength.

0.9910 remains the chart after serving as a bottom border for the pair in November 2012. It already managed to work as weak resistance in December 2012. 0.9880 showed that it is a clear separator in October 2012. It also had a role in the past. This line switches roles to upside resistance.

0.9817 was a stubborn peak in September and is now significant support. As seen in December 2012, this line worked as a cushion. Lower, 0.9725 worked as strong support back at the fall of 2011 and showed its strength once again in October 2012.

0.9667, which was another strong cushion in June 2011 is the next line. The round number of 0.96 provided some support back in 2011 and is minor now.

Further below, 0.9406 is the post crisis low.

Wide Uptrend Channel Clearly Broken

As the chart shows, the pair broke below uptrend support after chewing off this line a bit earlier. This is a bearish sign.

I remain bearish on USD/CAD.

With more QE from the US and an improving economic environment there, Canada can continue growing receiving positive flows. Also the recent positive jobs report and the fact that the price of oil has stabilized, providing more support for the pair.

Another technical view: USD/CAD Tentative Breakdown Below Support

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar.