The Canadian dollar suffered from a more downbeat tone from the central bank and lost ground to the US dollar. Will parity be reached soon? Many important events are scheduled for this week: The rate decision, retail sales and the BOC monetary policy report. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

Last week, consumer prices and core prices increased by 0.2% on a monthly basis; a bit weaker than expected reinforcing beliefs that the BOC will not change rates this coming week. Meanwhile Manufacturing Sales and Wholesale Sales surprised with better than expected readings indicating Canadian domestic economy continues to expand.

Updates: Core Retail Sales and Retail Sales will be published later on Tuesday. The markets are expecting a drop in both indicators. As well, the BOC will announce its key interest rate on Tuesday. The central bank is widely expected to maintain the current level of 1.0%. A Rate Statement will follow the interest rate announcement. The loonie continues to lose ground, as USD/CAD was trading at 0.9965. Core Retail Sales was up 0.4% for the second straight month. The estimate stood at 0.3%. The BOC handed down a dovish policy statement, saying that it was slightly more optimistic about the global developments, and the Canadian economy as well. As expected, the central bank maintained interest rates at the level of 1.0%.

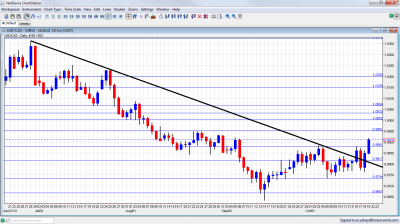

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Retail sales: Tuesday, 12:30. Canadian retail trade surged above expectations in July, rising 0.7% after a 0.3% decline in June. Economists expected a smaller gain of 0.2%. The increase came amid a jump in new car sales. Eight of 11 sectors showed expansion. Meanwhile sales excluding automobiles grew 0.4% in July, also exceeding forecasts for a 0.3% gain. Nevertheless these positive data was spoiled by recent declines in wholesale sales. CPI is expected to climb 0.4% while Core CPI is predicted to rise by 0.2%.

- Canadian Rate decision: Tuesday, 13:00. The Bank of Canada maintained its overnight rate at 1.0% in line with expectations but stated it may have to raise rates despite global slowdown and also may partially cease monetary stimulus due to rapid domestic growth however most analysts believe Mark Carney will refrain from tightening Canadian monetary policy. No change in policy is expected.

- BOC Monetary Policy Report: Wednesday, 14:30. In it last monetary policy report in July, BOC Governor Mark Carney said that Canadian economy growth rate is getting nearer to the end of its production capacity, exploiting its vacant resources. Therefore its monetary policy has to differ from other countries currently struggling with recession. The need of rate hikes and reduction in monetary stimulus is heard from financial officials.

* All times are GMT.

USD/CAD Technical Analysis

USD/C$ was initially capped under the 0.9817 line (discussed last week). It then moved higher, broke above 0.9880 and finally broke above this line.

Technical lines, from top to bottom:

We start from higher ground this time. 1.02 was the trough of 2009 and remains important since then, working in both directions. 1.0150 worked as support during June 2012 and is minor now.

1.0066 was key support before parity. It’s strength during July 2012 was clearly seen and it gave a fight before surrendering. Now, it is somewhat weaker. 1.0030 is another line of defense before parity after capping the pair earlier in the year. The move below this line is not confirmed yet.

The very round number of USD/CAD parity is a clear line of course, and the battle was very clear to see at the beginning of August 2012. Under parity, 0.9950 is now the top border of the range, similar to a role it played in March 2012. It also worked well as resistance in August 2012, in more than one occasion.

0.9880 now replaces 0.99, after capping the upwards movement and then working as a clear separator in October 2012. It also had a role in the past. 0.9817 was a stubborn peak in September and is now significant resistance. It is a weaker line at the moment.

Lower, 0.9725 worked as strong support back at the fall of 2011 and showed its strength once again in October 2012. 0.9667, which was another strong cushion in June 2011 is the next line.

The round number of 0.96 provided some support back in 2011 and is minor now. Further below we find 0.9550, which worked as resistance when the pair traded in low ground.

Downtrend Resistance Broken

Since the middle of June, downtrend resistance caps the pair. The pair touched the line two times since then, including in October, thus making it significant resistance. Another attempt to get closer was seen in October 2012.

I am bullish on USD/CAD.

The change of heart at the BOC paves the path for more losses for the loonie – gains for USD/CAD. In addition, the price of oil cannot move forward.

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- USD/CAD (loonie), check out the Canadian dollar.