The Canadian dollar reached a 14 month high against the greenback thanks to QE3. However, part of these gains are now fading away.

One of the reasons was a mysterious plunge in oil prices, despite rising tensions in various parts of the world. A disappointing Canadian figure didn’t help either.

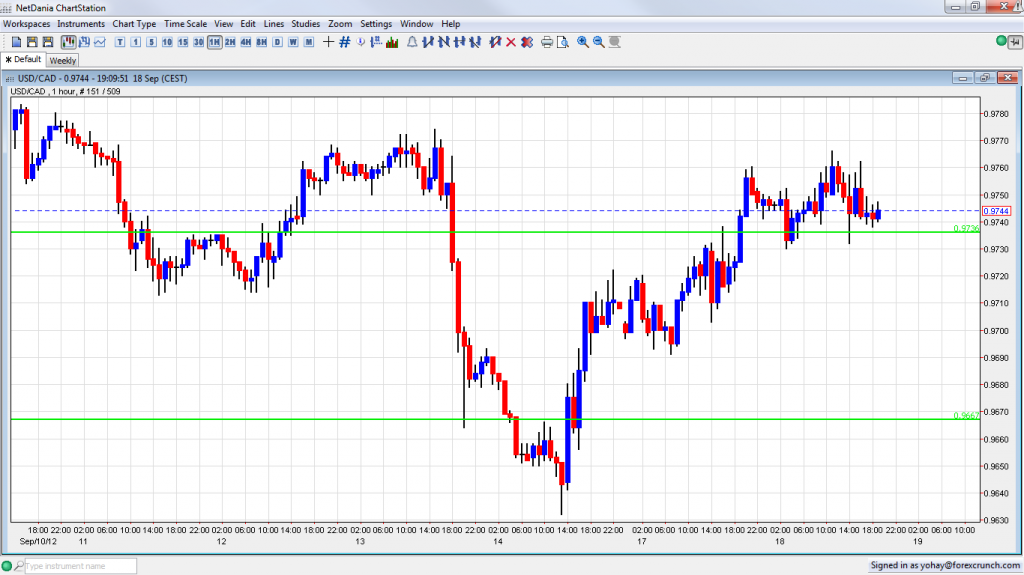

USD/CAD now trades around the 0.9740 line, unable to stick to lower ground:

Oil prices also enjoyed QE3, with WTI Crude reaching the magical number of $100. However, in a not-so-busy time in the markets, the price suddenly fell by around $4.5 before staging a limited recovery. This spike wasn’t triggered by any specific event, and is investigated by the CFTC.

While oil saw a recovery, the loonie didn’t really make a comeback. Another disappointment came from the Canadian Foreign Securities Purchases figure. This disappointed with only $6.67 billion instead of $11.3 billion expected. At least it was better than the negative number seen in the previous month.

All in all, USD/CAD is struggling to find a direction after the recent falls. 0.9740 remains a line of support after the pair climbed higher. A new break of this level opens the door to 0.9667 once again. In turn, this is followed by 0.96.

For more on the loonie, see the USDCAD forecast.