WTI Crude Oil continues falling, and now trades at $77.50. Brent Oil is also on the fall, trading at $83.20. These are fresh falls, without any known immediate trigger.

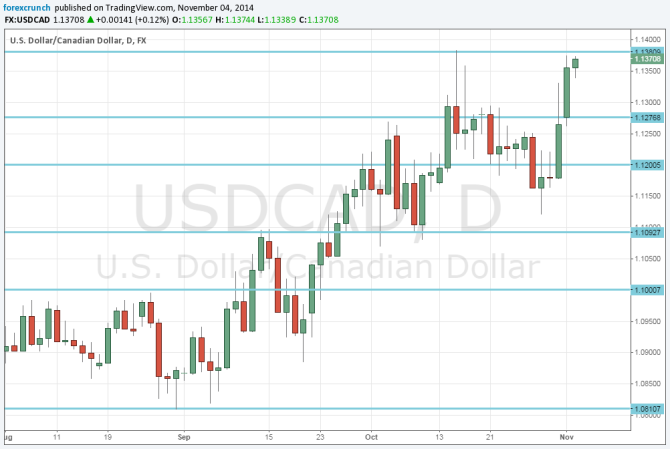

The Canadian dollar is falling, with USD/CAD trading at 1.1370, just 14 pips away from the highest level since 2009, which was 1.1384 recorded on October 15th.

For oil, the basics remain the same: lower forecasts for global growth mean lower demand, while rising supply from Libya, Saudi Arabia and the United States’ shale oil mean glut.

The relevant price for Canadian oil, coming out of Alberta tar sands as well as other places is the West Canada Select, but all oil prices are correlated.

Yesterday, Saudi Arabia reported a rise in oil prices in which it sells to Asia, but a cut in prices of oil sold to the United States. This means more pressure for Canadian oil as well. The prices of oil fell already then, but the moves accelerated now.