The Bank of Canada shocked markets with the first rate move in over 4 years, and it was to the downside: the cut of the rate to 0.75% sent the Canadian dollar down.

Is this a first move out of many or just a one-off event? And what will happen to the Canadian dollar? The team at CBA suggest buying dips and set a target for the pair:

Here is their view, courtesy of eFXnews:

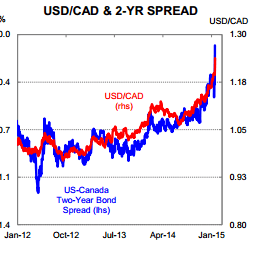

Following the spike higher in the wake of the surprise 21 January BoC decision, USD/CAD has now risen by over 16% from its July 2014 lows, notes CBA.

“In our view, further gains in USD/CAD should be expected. The combined power of these factors should see USD/CAD rise to 1.3000 by June 2015, in our opinion,” CBA projects.

“We would look to employ a strategy of buying USD/CAD on dips over coming months,” CBA advises.

&For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.