Dollar/CAD and Dollar/JPY are moving quite a bit while many traders focus on EUR/USD and GBP/USD. What’s next for these pairs? Here is the view from Westpac:

Here is their view, courtesy of eFXnews:

USD/CAD: The renewed decline in oil prices and last week’s dovish tilt from the BoC (“risks to the profile for inflation have tilted somewhat to the downside since July”) have put USD/CAD in a very precarious position. Against that backdrop we can’t confidently argue that USD/CAD will stick to its broad 1.28-1.32 range that has held for the better part of three months.

But the USD likely trades on the back foot next week amid a steady hand from the Fed, accompanied by a dovish dot plot profile including just 1 hike this year (and possibly a couple individual dots in favour of no move in 2016) along with another 25bp lopped off the long term neutral rate.

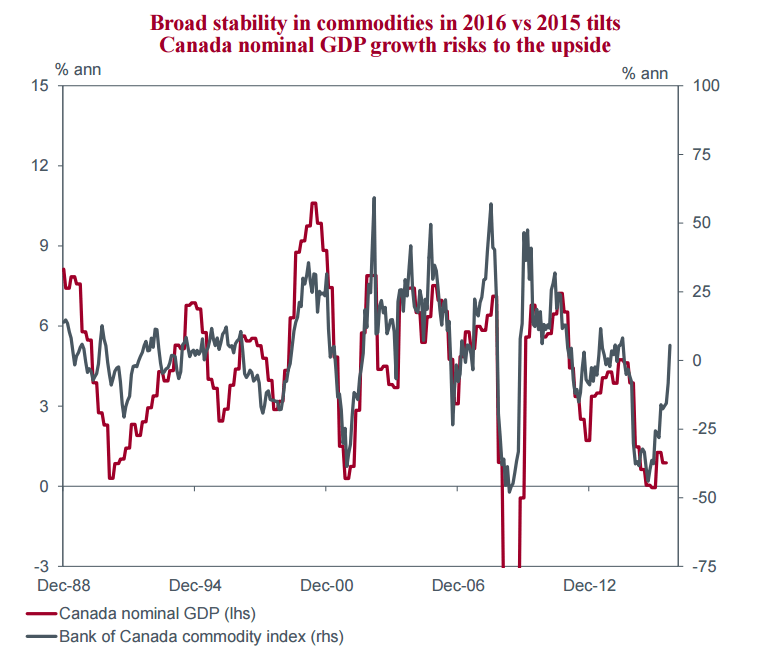

Canadian growth prospects look perky as activity comes back on stream after the Alberta fires and as Trudeau’s fiscal stimulus kicks into gear.

On balance still feel selling USD/CAD will ultimately prove more rewarding trade but patience is required. USD/CAD a sell at 1.3250 with a tight stop.

USD/JPY: We remain of the view that the BoJ is close to the extremes of its JGB asset purchase program and that it is probably unwilling to open up other asset purchase strategies because of the potential costs involved. We do expect to see 10bps of NIRP too (i.e. -0.2%), given the extent to which depository corporations are long cash. Thus, given the market’s reaction to NIRP in January, the obvious point to make here is that we should expect to see some pretty violent swings in the ¥ Wed/Thu next week.

With the Fed on hold, the possibility that we see another 12.5/25bps lopped off the longer run dots, the risks are clearly to the downside for $/ ¥. We target 100, but see it lower.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.