As a NAFTA signatory, Canada has a special trade relationship with the US and Mexico, although the bulk of trade, 74% of all exports and 55% of all imports is between the US and Canada. Of that, nearly 34% are petroleum or petroleum related products; nearly 20% are transportation related including manufactured aircraft or components and about 7.4% are industrial metal ore; semi-refined or completed products. The point is that 60% of exports to the US are core to the Canadian commodity dependent economy. Thus the US Dollar-Loonie exchange can have an impact on the Canadian economy. Further, global petroleum prices, in general, can also impact their economy.

The Bank of Canada often factors in US economic activity in its monetary policy. For example, in the most recent monetary policy meeting, 25 May, the BOC noted that “…In the United States, despite weakness in the first quarter, a number of indicators, including employment, point to a return to solid growth in 2016. Financial conditions remain accommodative, with ongoing geopolitical factors contributing to fragile market sentiment. Oil prices are higher, in part because of short-term supply disruptions…”

Guest post by Mike Scrive of Accendo Markets

There are two important points to be made here. First, the meeting preceded the release of below estimate US economic data, in particular, data significantly below estimates. Second, the ‘supply disruption’ was due to damage caused by wildfires in Canada’s Alberta province oil fields. Oil production in Nigeria and Venezuela has also declined due to political instability. The Canadian fields are currently being brought back on line, but the situation in Nigeria and Venezuela may last quite a bit longer.

The BOC specifically noted the effect on GDP caused by fire damage: “…In Canada, the economy’s structural adjustment to the oil price shock continues, but is proving to be uneven. Growth in the first quarter of 2016 appears to be in line with the Bank’s April projection, although business investment and intentions remain disappointing. The second quarter will be much weaker than predicted because of the devastating Alberta wildfires. The Bank’s preliminary assessment is that fire-related destruction and the associated halt to oil production will cut about 1 1/4 percentage points off real GDP growth in the second quarter. The economy is expected to rebound in the third quarter, as oil production resumes and reconstruction begins…”

Lastly, the importance of the US Dollar-Loonie exchange rate is a major concern and noted in the statement: “…While the Canadian dollar has been fluctuating in response to shifting expectations of US monetary policy and higher oil prices, it is now close to the level assumed in April…” It’s important to point out again that the BOC meeting occurred well before the announced US May economic data.

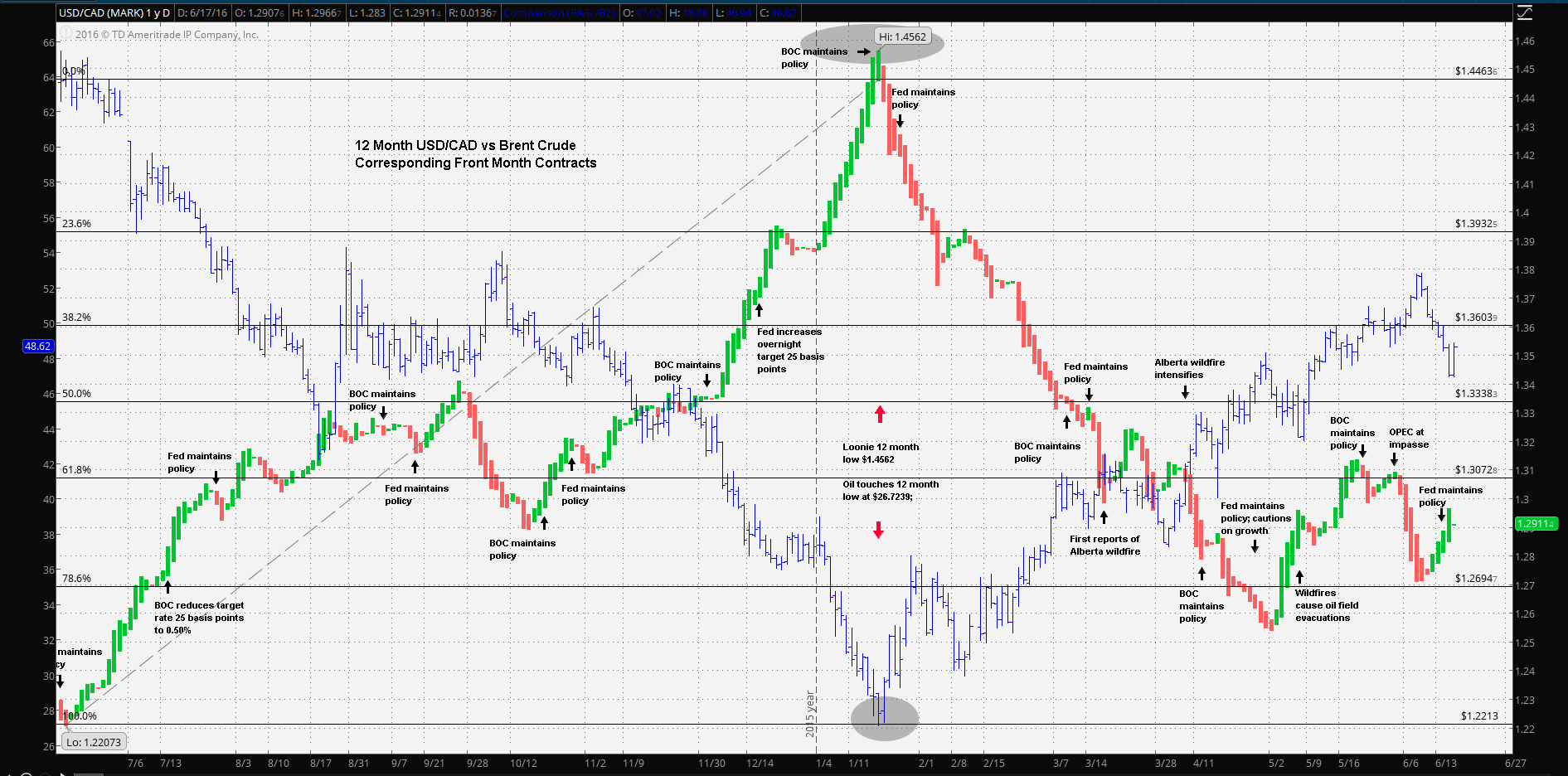

What’s most surprising is that at the time of the BOC 25 May meeting, it was widely expected that the US Fed would decide to increase the target Fed Funds rate another 25 basis points. Naturally, this would have strengthened the US Dollar vs the Loonie and potentially eased pressure for the BOC to reduce its already long standing record low 0.50% target rate. The combination of a Fed increase and dominant bilateral trade relationship would be just as beneficial as a 25 basis point reduction on the part of the BOC. The above chart demonstrates the correlation between the USD/CAD exchange and Brent Crude.

The dynamic here is interesting. US gasoline and diesel fuel demand is near record highs, but so are supplies. Canada is a primary supply source for the US market, including refined petroleum products. Hence, it seems that the poor US economic data as well as a vehicle fuel supply glut, in spite of record demand, has dashed the expectations for Canada to ride the US recovery wave.

At the 15 June Fed press conference, the Fed expressed its optimism that targets would eventually be attained, however, seemed to have implied a negative bias, noting that “…Economic growth was relatively weak late last year and early this year… …Also, activity in the energy sector has obviously been hard hit by the steep drop in oil prices since mid-2014. But the slowdown in other parts of the economy was not expected. In particular, business investment outside of energy was particularly weak during the winter, and appears to have remained so into the spring. In addition, growth in household spending slowed noticeably early in the year despite solid increases in household income as well as relatively high levels of consumer sentiment and wealth…”

Further, the expectations for several gradual Fed rate increases may no longer be certain: “…We expect the [Fed Funds] rate to remain, for some time, below levels that are anticipated to prevail in the longer run because headwinds weighing on the economy mean that the interest rate needed to keep the economy operating near its potential is low by historical standards. These headwinds–which include developments abroad, subdued household formation, and meager productivity growth–could persist for some time…”

Lastly, and most troubling for the BOC may be observed in the conclusion of the FOMC statement: “…Maintaining our sizable holdings of longer-term securities should help maintain accommodative financial conditions and should reduce the risk that we might have to lower the federal funds rate to zero in the event of a future large adverse shock…”

Clearly, the Fed may have been alluding to the UK referendum and thus the higher potential for a global recession. The combination of an underperforming US economy and a global slowdown in the face of still excessive global petroleum production, the BOC may have to reduce further, if not at the 13 July meeting, then at the following 7 September meeting, depending, of course, on the performance of the non-mining sectors of the economy.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.“