Technical Bias: Neutral

Key Takeaways

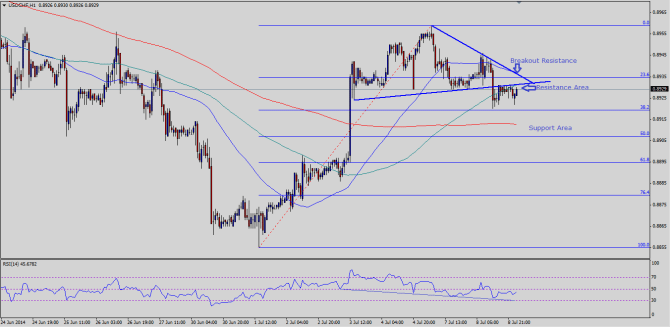

“¢ US dollar is consolidating around key area after posting a short-term high against the Swiss franc at 0.8960.

“¢ FOMC meeting minutes to be released today, which might act as a catalyst for the USDCHF pair.

“¢ USDCHF support seen at 0.8910 and resistance ahead at 0.8940.

The US dollar buyers seem to be nervous ahead of the FOMC meeting minutes which will be released today, which might ignite a lot of volatility in the market.

Technical Analysis

There was a bullish trend line connecting all recent lows on the hourly timeframe for the USDCHF pair. Yesterday, the pair moved lower and broke the mentioned trend line to close on a negative note. However, after the break, the pair managed to hold the 38.2% Fibonacci retracement level of the last move higher from the 0.8855 low to 0.8959 high. In addition to the trend line break, the pair is now trading below the 50 and 100 hourly simple moving average (SMA), which can be considered as a bearish sign. Currently, the pair is retesting the broken trend line, which is acting as a resistance and holding the upside in the pair. If it continues to struggle, then sellers might try to take the pair lower and if they succeed in breaking the 38.2% fib level, then a run towards the 200 hourly SMA, followed by the 50% fib level is quite possible moving ahead.

On the other hand, if the pair breaks higher, then there is a bearish trend line connecting recent highs which could act as resistance. This trend line is also coinciding with the 50 hourly SMA. So, it the US dollar buyers take charge and break the mentioned trend line resistance zone, then it would call for a re-test of the 0.8959 high.

FOMC Meeting Minutes

Today is probably one of the most important days for the US dollar this week. The FOMC meeting minutes will be published. It would be interesting to see whether the minutes will ease or accelerate the dollar’s move moving ahead.