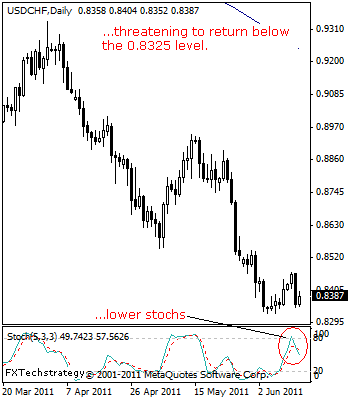

USDCHF: Setting Up For A Return To The 0.8325 Level.

USDCHF: With its inability to sustain its past week momentum, USDCHF could be headed towards its Jun 05’2011 low at 0.8325.

Guest post by www.fxtechstrategy.com

If this level is taken out, the pair will resume its long term downtrend towards the 0.8300 level, representing its psycho level.

A turn below this level will set the stage for a further push lower towards the 0.8200 level and the 0.8100 level, marking its psycho levels.

Its daily stochastics is bearish and pointing lower suggesting further weakness. Alternatively, the pair will have to return above its Jun 13’2011 high at 0.8465 to open the door for additional gains towards its May 04’2011 low at 0.8551.

A reversal of roles as resistance is expected to occur and turn the pair back down at that level. Another resistance is located at the 0.8746 level, its May 20’2011 low and possibly higher.

All in all, USDCHF remains vulnerable to the downside in the long term as it looks to resume that trend.

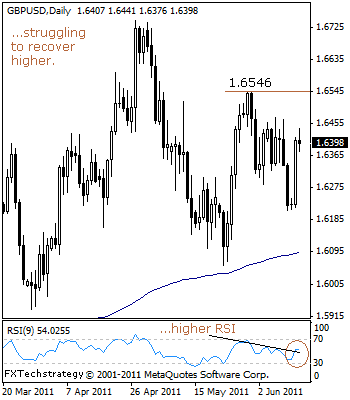

GBPUSD: Recovering With Caution.

GBPUSD: The pair is now hesitation following its strong rally on Monday. GBP will have to climb back above the 1.6546 level, its May 31’2011 high to prevent a return to the 1.6211 level, its Friday low.

Above the 1.6546 level will call for a run at the 1.6743 level, its 2011 high and then the 1.6877 level, its Nov’2009 high.

A loss of the latter level will pave the way for further strength towards its bigger resistance at the 1.7039 level, its 2009 higher.

Alternatively, a break and hold below the 1.6211 level will pave the way for further weakness towards the 1.6105 level, its May 18’2011 low and possibly lower towards the 1.6000 level, its major psycho level.

All in all, GBP looks to recover higher on the back of its Monday gains though presently hesitating.