USDJPY has dropped spectacularly in recent days. Amazingly on January 1st 2012 USDJPY was trading at 86 and before Abe was elected Prime Minister of Japan it was trading even lower.

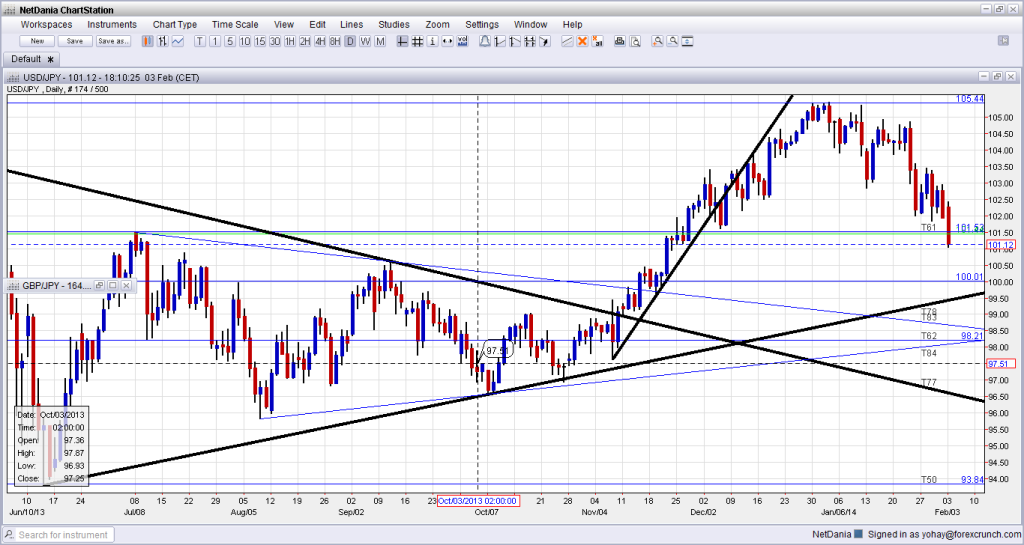

The first phase of USD/JPY strength was driven by the aggressive $1.4 trillion stimulus program announced by the Bank of Japan on April 4th 2013. USDJPY then spent most of the period after May putting in a triangular resistance pattern which lasted all the way to November.

It wasn’t until late November that the rally took off once again but this time, the move was triggered by expectations for Fed tapering. Triangular resistance turned support comes in beneath 100 while the rising 200 period MA which held twice in October and one in November sits at almost exactly 100.

The Japanese Prime Minister Shinzo Abe’s economic policy can be broken down into 3 main components known as the “three arrows” – massive monetary easing, expansionary fiscal policy and a long-term growth strategy. The first two was aimed at putting Japan on a growth track and the third is to solidify the recovery. The strong bullish rising trend in USDJPY is un-mistakable and extending out the moves from 2012-2013, projects a target of 110-112 for 2014.

Guest post by Gary Comey – www.fxlight.co