The US dollar is on a roll. Is it a correction to the dollar weakness we have seen earlier? Or seeing the glass half full in the NFP? The drop in wages is not really encouraging.

Nevertheless, the best expression of the greenback’s strength is in USD/JPY. This is often the best pair to reflect breaking economic news from the US. In addition, the rally in this pair is fueled by less demand for the safe haven yen. The landslide win of the young candidate is a relief for the markets. No risk means no demand for the Japanese currency.

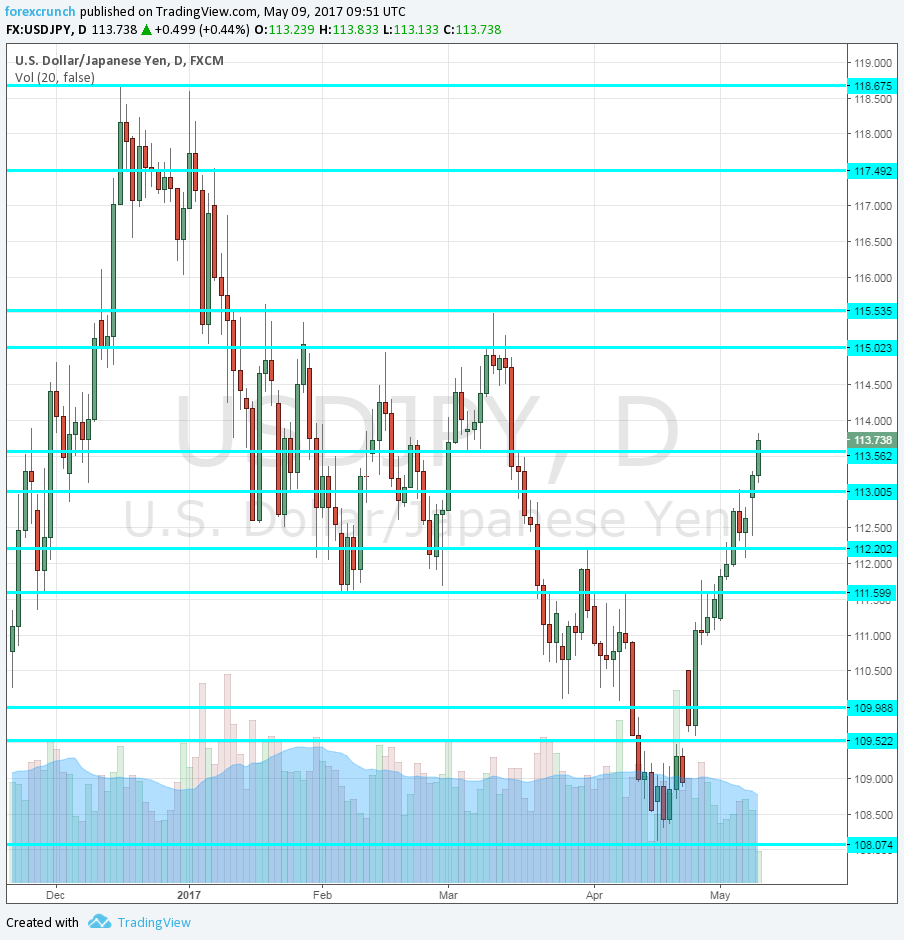

The pair is already over 550 pips above the lows at 108.07 low seen in mid-April, trading at 113.70. The high so far has been 113.83

USD/JPY technical levels

The next level to watch is the round number of 115. Such round levels trigger comments from policymakers. In addition, it was a high level back in early February.

Closely up the ladder, we find the March high of 115.53. The next level of resistance is only at 117.50, the last swing high before the pair fell to the downside. The last line to the topside is 118.70, which is the post-US elections high and is still a bit far out.

On the downside, we just crossed the resistance line of 113.50, a low level in March. Further below, 112.20 was the high point in early April. The next two cushions were triple bottoms: 111.60 and 110. And the last level is 108.07.

More: The impact of News shocks on the market