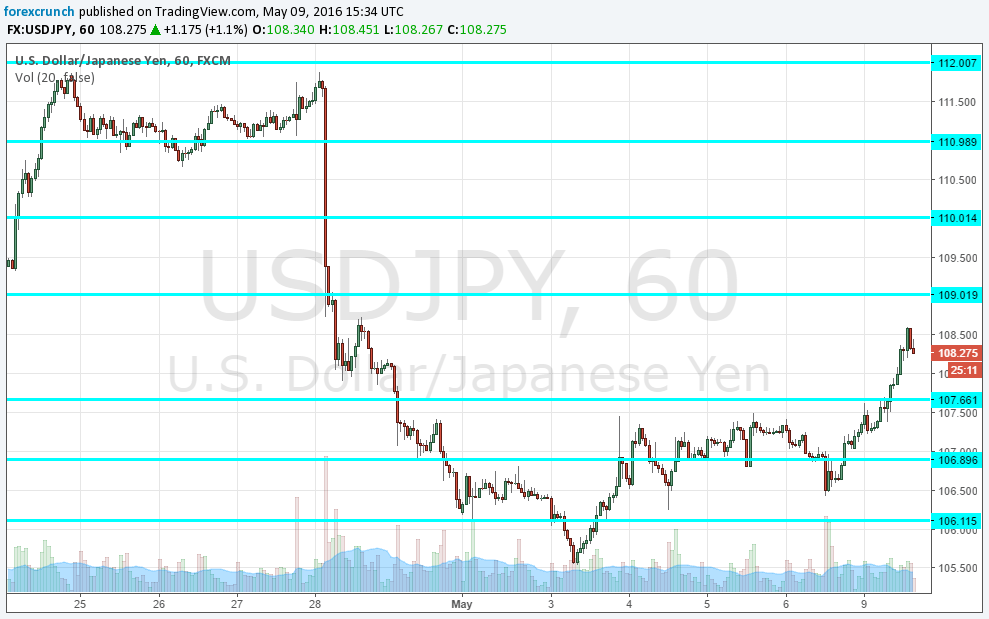

Dollar/yen had some trouble breaking above 107.65, the line that lent it support before another crash. This line worked as resistance afterwards but couldn’t hold on. The pair made a move above this level and made a swift move for an additional 100 pips all the way to 108.60.

There was no yen related event that could have led to this weakening. The various officials in the Japanese government continued to talk their usual talk about a danger of excessive moves in foreign exchange, but they did not really say something new.

Here are 3 reasons why the Bank of Japan could be behind the move:

- Favorable environment: We can suspect that the BOJ has something to do with it because of the timing: it is very hard to “catch a falling knife” – to try to stop a very strong trend. The officials in Tokyo refrained from intervention while the yen was strengthening: it would have probably failed and only led to a dampening of their credibility. But things have changed since last Tuesday: the US dollar is back in the saddle, making a significant recovery. This was clear in the response to the mixed NFP report: after a short dip on the weak headline, the greenback staged another move forward, taking advantage of the wage data and basically just extending its trend.

- No risk-on: Are we seeing a risk-on reaction that weakens the yen? No. Chinese trade data disappointed and Greece is an open wound in Europe – not a very positive environment. This is the atmosphere in which the yen would strengthen, not weaken.

- No new USD strength: The move can be attributed to further USD strength as well, but we are not seeing the same strength against the euro or the pound. Commodity currencies are weakening as well, but not as much as the yen.

The moves last week were enough for a bounce from the lows but the pair did think twice before crossing the 107.65 level.

Not anymore.

The big break higher sent it to a high level before a potential challenge of the 109 level. Further resistance awaits at the round 110 line.

Do you think we had some BOJ intervention to weaken the yen? Here is how the move looks on the chart: