Dollar/yen was leaning lower in a week that saw further political issues for President Trump. Nevertheless, the pair maintains a distance from the 108.10 level which remains critical. A calmer atmosphere towards the end of the week allowed for some selling of the safe-haven yen.

USD/JPY fundamental movers

OK data, messy politics, Jackson Hole

US data was OK, or at least, not too bad for the dollar. While sales of new homes missed with 571K, it was accompanied by a revision tot eh upside. Markit’s PMIs went in opposite directions and existing home sales were OK.

The trouble came from politics, once again. Trump’s threat to shut down the government for funding the wall (originally Mexico was expected to pay for it according to the president) rattled markets. It helped the Japanese yen while it was trying to recover.

The speakers at Jackson Hole did their best not to rock the boat, but Yellen’s lack of hawkishness sent the dollar down.

A busier week with NFP and GDP

The last week of August and the first day of September provide a lot of action. A revised measure of GDP, consumer confidence and a short buildup to the Non-Farm Payrolls stand out. Will wages finally rise in the US? The report for August will probably show more of the same.

See all the main events in the Forex Weekly Outlook

In Japan, we will get industrial output, retail sales, and unemployment. However, politics in the US and geopolitics will move the safe-haven yen more than anything else.

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

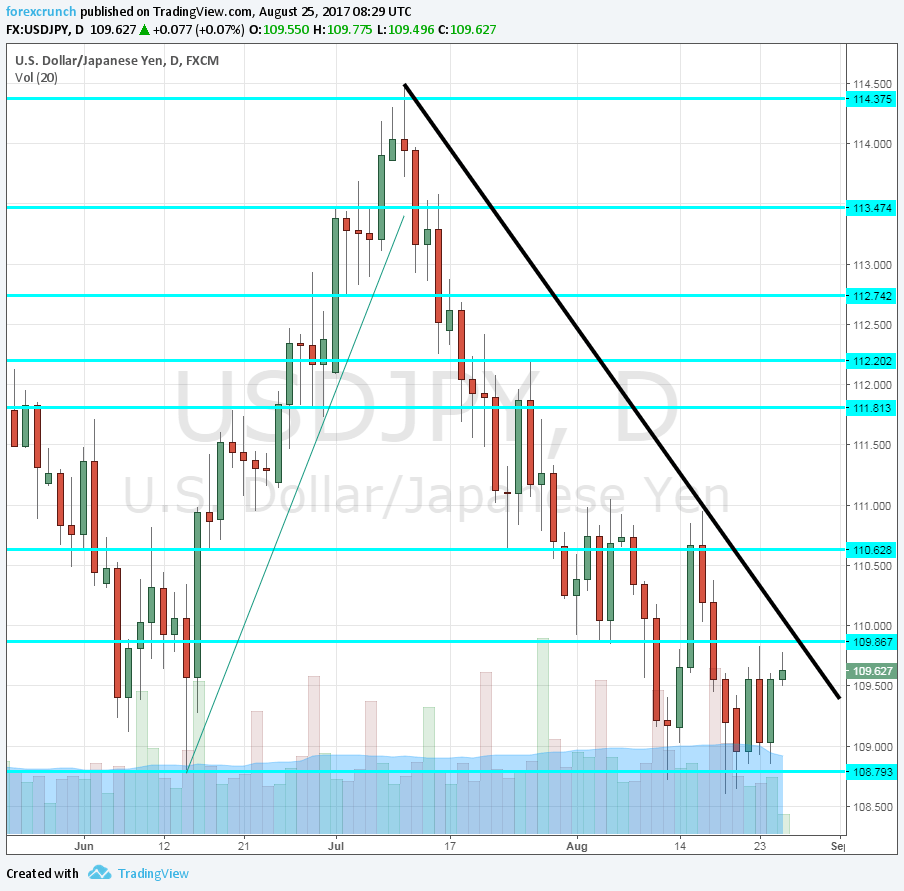

115.35 is the next line of resistance in case the pair break the cycle high of 114.30 which remains critical resistance after capping the pair back in May. The break to 114.50 did not go very far.

113.50 was a temporary line of resistance on the way up in July. 113.70 was a separator of ranges in June.

112.20 used to be important in the past. It is closely followed by 111.80, which capped the pair in May.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance. Looking lower, we are back to levels seen in November, but the door is basically open to 105.

Downtrend resistance

As the black line on the chart shows, the pair is capped by downtrend resistance formed at the peak of 114.50 and followed

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

The lack of enthusiasm by the Fed to raise rates, alongside worries about a government shutdown, all work against the US dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!