The US Congress has reached a deal to keep the government running until September. The initial agreement was only for one week, but politicians took the window seriously and reached a deal for a few more months.

The issues of a government shutdown and hitting the debt ceiling have plagued American politics in recent years. The situation looked more serious when Republicans were opposing Barack Obama. Nevertheless, an issue that was on the backburner became concerning after some internal Republican infighting.

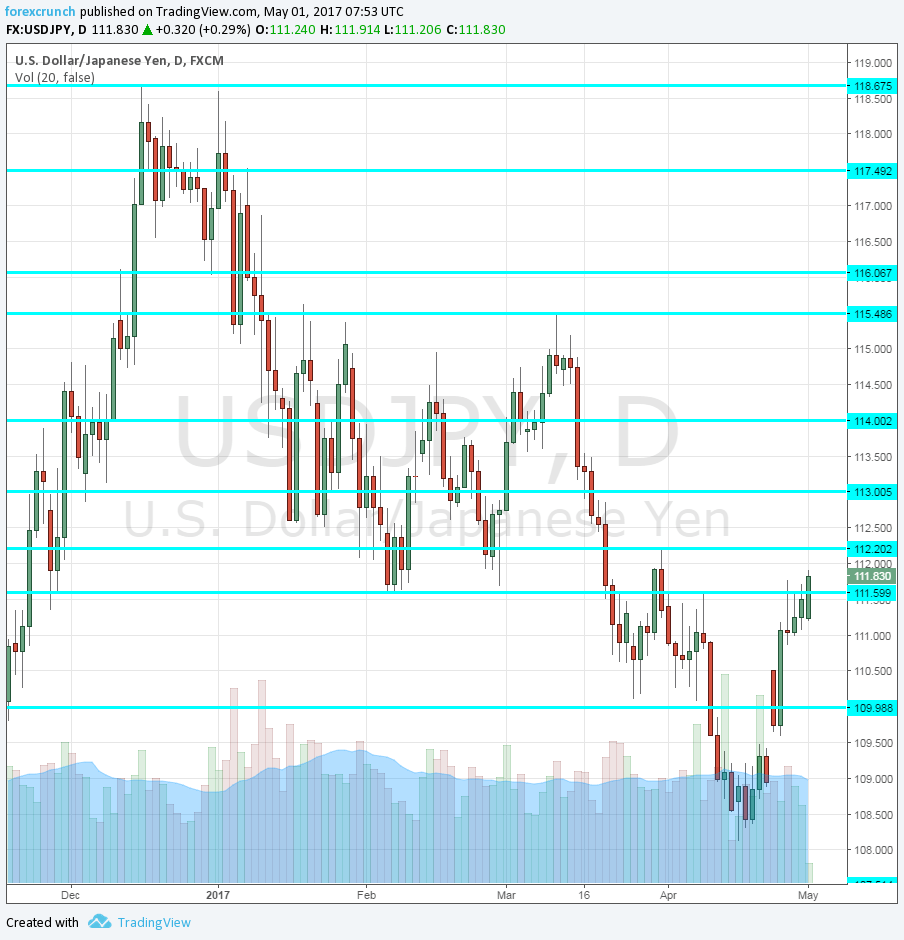

USD/JPY movements

The news coming out from Washington was a relief for the US dollar, especially against the safe-haven yen. USD/JPY is trading on higher ground, at 111.84. The peak so far was 111.91. Resistance awaits at the round level of 112, followed by 112.50.

The pair is trading at the highest level since the end of March, reversing the downfall to 108.10 it had experienced beforehand.

Dollar/yen was already moving up on the results of the French elections. With centrist Emmanuel Macron winning the first round, optimism replaced fear and demand for the ultimate safe haven, the yen, diminished.

In Japan, Markit’s final manufacturing PMI showed slightly slower growth with a score of 52.7 against 52.8 originally reported. The Japanese economy is doing OK, but not going anywhere fast. Last week, we learned that the unemployment rate fell to 2.8%.

The Bank of Japan is probably quite happy with the economy and the recent weakness of the Japanese yen which helps them get closer to their inflation target. However, core prices are very far from the 2% target.

Here is the dollar/yen daily chart: