Dollar/yen was initially on the back foot, erasing some of its gains. This time, the tensions around North Korea had a longer-lasting effect. Janet Yellen also had her say, for a second week in a row, but did not stir markets. The biggest driver seemed to be tax reform. Markets are becoming optimistic that the Trump Administration will get things done.

USD/JPY fundamental movers

Fed hesitation, North Korea yet again

The Fed decision is behind us and so is the quiet period. Fed officials seem relatively hesitant about raising rates in December. They surely don’t speak with one voice.

North Korea said that the US has “declared war” and that it has the right to attack American “strategic bombers”.This had the regular effect of downing USD/JPY, and this time it had a larger effect than usual.

President Donald Trump introduced the outlines of a massive tax reform. This consists of a cut in the corporation tax from 35% to 20% and this certainly gave a boost to the dollar. How will these tax cuts be funded? What are the exact details? Will it pass? These uncertainties could eventually reverse the gains if the concerns are not addressed.

Japan will indeed go tot he polls in October. Abe wants to consolidate his power but he may face a challenge from the Governor of Tokyo.

Build up to the Non-Farm Payrolls

Q3 starts with top-tier indicators. The Non-Farm Payrolls on Friday is key. Wages remain as important as job gains. It is preceded by a big buildup: the ADP NFP and both ISM PMIs.

In Japan, opinion polls could move the yen, but the US remains in the limelight.

See all the main events in the Forex Weekly Outlook

Key news updates for USD/JPY

[do action=”autoupdate” tag=”USDJPYUpdate”/]USD/JPY Technical Analysis

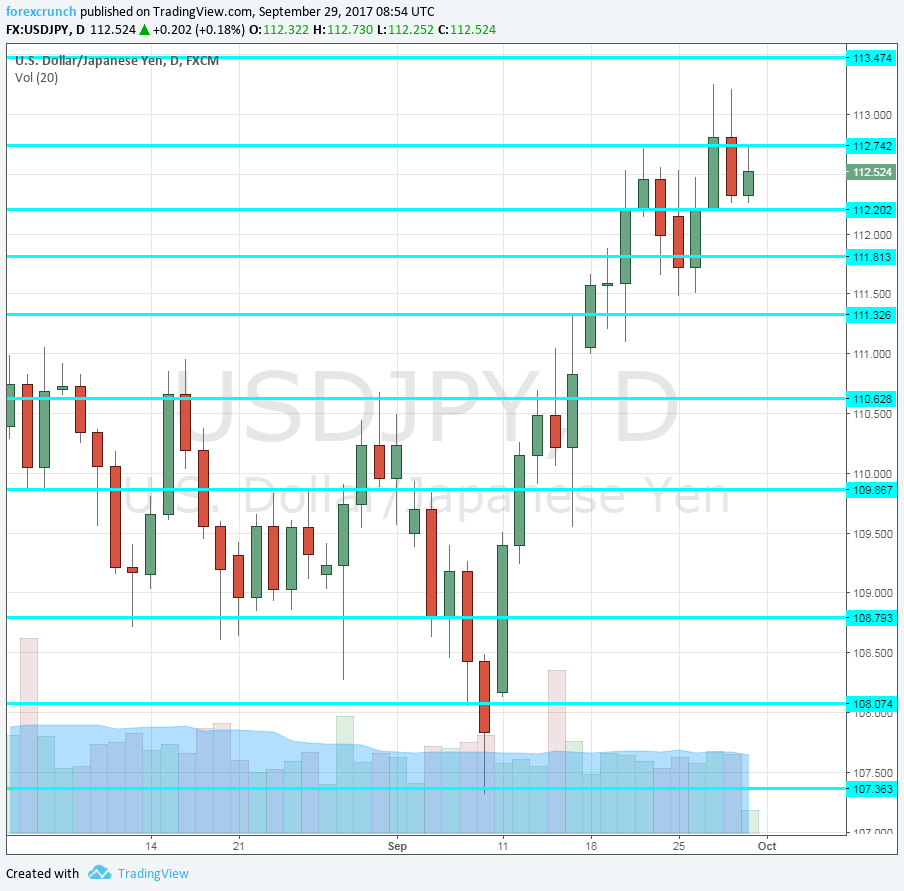

113.50 was a temporary line of resistance on the way up in July. 113.70 was a separator of ranges in June.

112.20 used to be important in the past. It is closely followed by 111.80, which capped the pair in May. The swing high of early September at 111.30 serves as another point of interest.

Looking down, 110.70 was a separator of ranges in June and remains important. 109.60 was a gap line in late April, a gap that was never closed.

In June, the pair found support several times at 109.10 and this also works as support. Further below, the cycle low of 108.10 is of high importance.

The trough of 107.35 seen in early September serves as another cushion on the way down.

Looking lower, we are back to levels seen in November, but the door is basically open to 105.

USD/JPY Daily Chart

USD/JPY Sentiment

I remain bearish on USD/JPY

The reaction to the growing tension to North Korea is telling. In addition, the Fed is hesitating about the hike in December.

Our latest podcast is titled Euro troubles and golden opportunities

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

Safe trading!