The US will not go to war with Syria unless its allies are with them. However, the UK and France will not be heading into Syria until the UN investigations are complete and the results are given. This geopolitical event has put pressure on the dollar. However the USD had gained after sound economic data came out on Thursday (30/08/2013). This data included the annualised preliminary GDP rate and US jobless claims both of which had beaten forecasts. The sound economic data coming out of the US recently implies that tapering could start as early as next month, although next week’s US non-farm payrolls data (06/09/2013) will be a key figure to watch as this may inevitably decide when tapering will start. Further, there still remains the concern that the US may reach its debt ceiling limit in mid-October.

On Friday (30/08/2013), Japan received mixed data. Unemployment had fallen to 3.8%, a drop of 0.1% from the previous rate. CPI (Consumer Price Index) was 0.7%, an increase by 0.3% from the previous rate. However, consumer spending and industrial production dipped, which shows that consumers are not confident with the government and BOJ’s plans.

ShinzÅ Abe (Prime Minister of Japan) is holding a meeting next week to discuss plans on a sales tax hike. There are concerns on whether the sales tax hike may dampen spending and thus may hamper the current recovery if salaries don’t increase. Currently the Yen is becoming stronger which is not helping exports. In addition, much of the increase in the value of the Yen is attributed to tension in Syria and it has become a safe haven.

Guest post by Accendo Markets

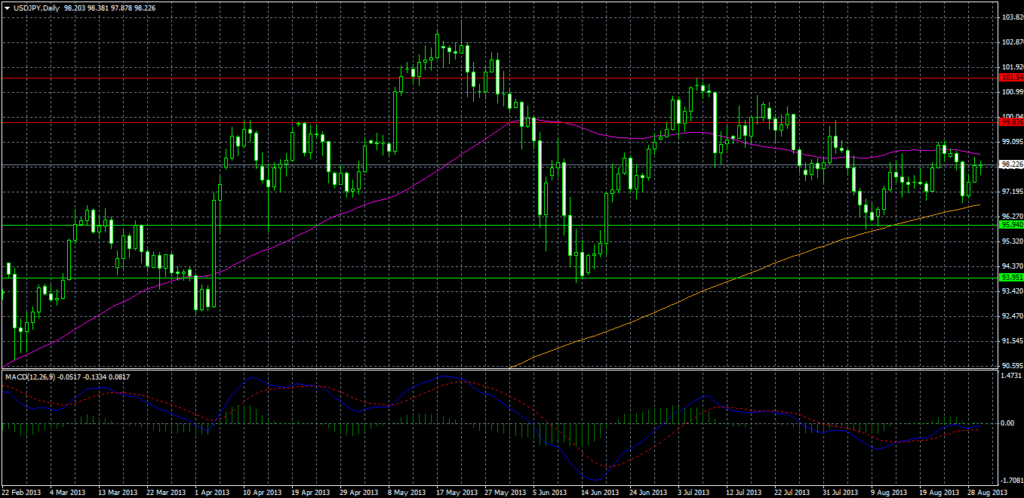

|

Support 2 (S2) |

Support 1 (S1) |

Current Price |

Resistance 1 (R1) |

Resistance 2 (R2) |

|

93.951 |

95.940 |

98.226 |

99.835 |

101.544 |

The pair had been in a bearish channel. It then broke this channel and is now trading in a sideways market. The pair is currently trading between our S1 and R1. S1 is a moderately strong floor for the pair which has tested this level once (Early August). S2 is a strong support for the pair. It is the lowest low the pair has been since April 2013.

R2 is also a strong ceiling and this is the pair’s highest high since late May 2013. R1 is also a moderately strong ceiling.

Technicals: MACD (Moving Average Convergence-Divergence) and Moving Averages

“¢ 50-day MA (magenta line) is in a downtrend which is acting as a supplementary resistance level to R1 and R2. However we note that the 200-day MA (orange line) is providing additional support to the pair as can be seen from the bounces off the MA recently.

“¢ MACD is below zero. The MACD line is above the red signal line indicating a bullish stance for the pair.

In the short-term the pair is bearish. The US is likely to reach its debt ceiling by mid-October. With this as a major concern for the greenback we could see investors invest in safe havens such as the Yen. However, the appreciation of the Yen will only make matters even worse for Japan’s export market. This is likely to have a trickledown effect in Japan with worsening corporate balance sheets and cutting expenditure as firms try to keep costs low. Next week should prove interesting for the US as we will obtain data of US non-farm payrolls which may dictate when QE will be tapered.

In the long term the pair is bearish. Japan is likely to keep to their policy of a sales tax hike and although Haruhiko Kuroda (BOJ Governor) insists that this will not hamper the recovery it may still do so. A higher sales tax is also likely to cut consumer expenditure unless salaries do not increase. The only way around this is to increase the sales tax by a small amount each month. In the US when tapering is initiated the USD will increase in value against the Yen although sorting out the debt ceiling is still on the cards.

CFDs, spreadbetting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.