The safe haven currency is in demand once again. The trigger is seemingly the report about Russian hacking into a US company that provides voting machines. According to a leaked report from the NSA, factors related to the Russian government targeted employees in a company providing voting machines, using phishing schemes.

So far, the assumption was that Russia tried to influence the vote by influencing voters and leaking information from the DNC. The voting process itself was thought to be left untouched. This report casts doubt.

Comey testimony overshadows infrastructure effort

The publication comes ahead of former FBI Director Comey’s testimony on Thursday. The White House decided to let it go through, not invoking the “Presidential Privilege” to prevent his appearance.

And all this happens when the Trump Administration is finally coming around to address the election promises regarding infrastructure. Hopes for infrastructure spending and tax cuts were behind the dollar rally. If these initiatives are derailed, so is the dollar.

USD/JPY – safe haven flows

The drops in dollar/yen go hand in hand with the fall in US yields. Bond yields jumped after the disappointing jobs report on Friday, which showed stalling wages and a worse than expected job growth number at 138K. The Fed is still expected to go through with a hike, albeit a dovish one.

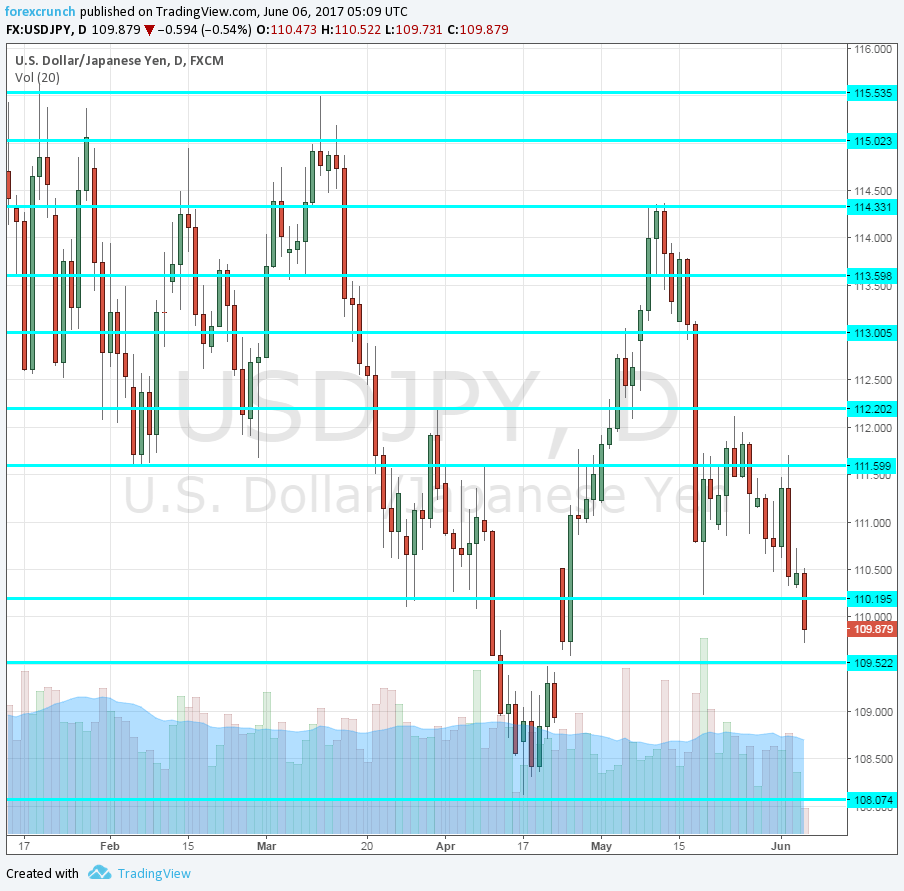

Here is the USD/JPY daily chart. Immediate support is at 1.09.50, followed by the cycle low of 108.10. Resistance awaits at 110, followed by 111.60.

More: USD/JPY: Political Risk & Equity Market In The Driver’s Seat; What’s Next? – Credit Agricole