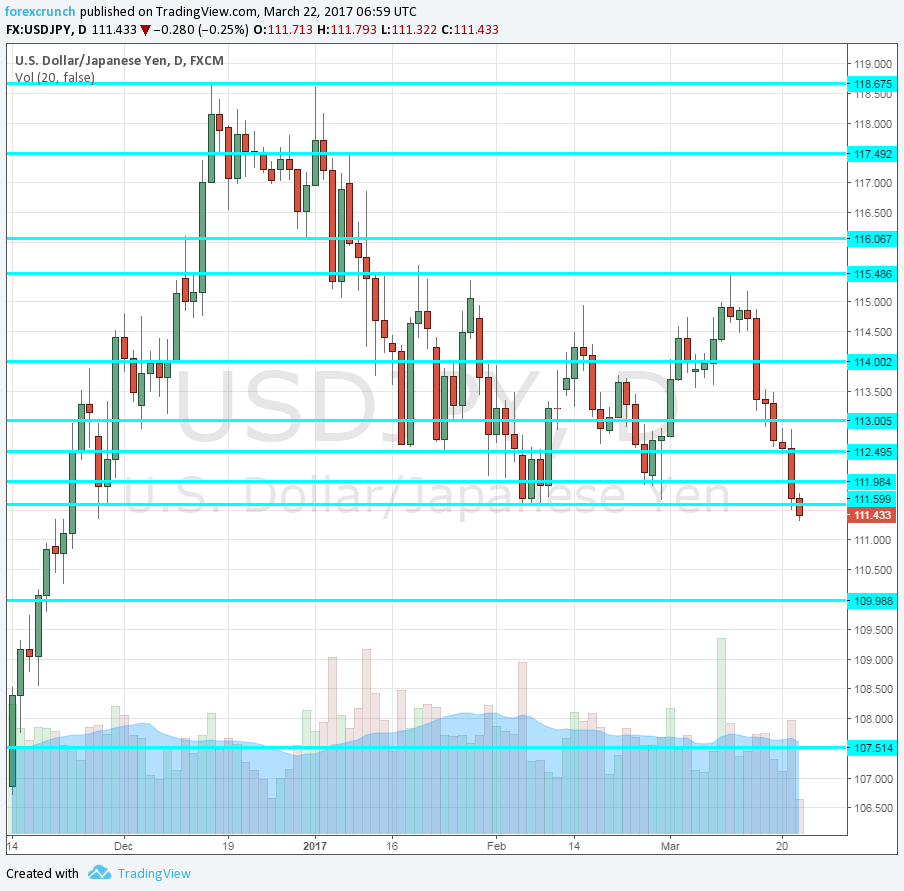

The initial move towards the triple-bottom of 111.60 did not result in a breach of this magical level. US traders left the job to Asian traders, which pushed the Japanese currency below the point just as European traders sip their morning coffee.

USD/JPY is now trading at 111.40, a level last seen on November 28th, a near five-month low. The tough so far has been 111.32, but we could see further dives once European markets are fully open.

Back in November, dollar/yen climbed all the way from 101, on the night of the US elections, to a much higher range above 111.60, extending to a double-top of 118.67.

The primary driver of the pair to the downside is the dovish hike by the Federal Reserve. Yellen and her colleagues telegraphed the rate hike in advance and eventually delivered a hike that lacked a change in outlook. This resulted in a massive sell-off of the greenback which refuses to die down.

The drop in stock markets seen yesterday has exacerbated the situation, especially for this particular pair. The yen is a haven currency, enjoying flows in times of trouble.

Further support awaits only at the very round level of 110, and that is followed by 107.50.

More: Hesitant to Short EUR Into French Elections; Short USD/JPY Preferable – Nomura