USD/JPY consolidated the big gains made in the previous two weeks. Comments regarding the fiscal cliff have a bigger impact on the pair, as do comments from Japanese politicians towards the December 16th elections. Capital Spending and Masaaki Shirakawa’s speech are the main events this week. Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Industrial production in Japan edged up unexpectedly by 1.8% in October, contrary to predictions of a 1.8% decline and following a 4.1% contraction. The main contributors for this rise were electronic parts, fabricated metals and transport equipment. Will Japan’s manufacturing sector manage to pull Japan from its ongoing recession?

Updates: Capital Spending slowed last month, posting a 2.2% gain. The estimate stood at 3.7%. BOJ Gov Masaaki Shirakawa spoke at the Paris-Europlace Forum in Tokyo. Monetary Base rose 5.0%, well below the estimate of 11.4%. The yen continues to improve against the dollar. USD/JPY has fallen below the 82 line, and was trading at 81.85. Average Cash Earnings gained a modest 0.2%, below the estimate of 0.4%. Leading Indicators will be released on Friday. USD/JPY is choppy, and was trading at 82.36.

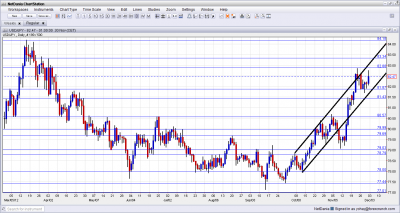

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- Capital Spending: Sunday, 23:50. Japanese companies increased capital spending by 7.7% in the second quarter compared to a year earlier. This was the third straight climb following last year’s earthquake. This reading was preceded by a 3.3% rise in the first quarter. However gains in capital expenditure when compared to a year ago may be exaggerated since that was right after a record earthquake and tsunami triggered a nuclear disaster in March 2011. A further increase of 4.5% is expected now.

- Masaaki Shirakawa speaks: Monday, 4:00. BOJ Governor Masaaki Shirakawa is scheduled to speak in Tokyo. He may discuss his efforts to restore the country’s fiscal health speed up domestic in order to resume a moderate recovery after periods of weakness.

- Monetary Base: Monday, 23:50. The monetary base in Japan climbed 10.8% on a yearly base reaching 128.134 trillion yen. The rise was above forecasts for an increase of 9.2% following the 9.0% gain in September. Another increase of 11.4% is expected this time.

- Average Cash Earnings: Tuesday, 1:30. Japanese total cash earnings remained unchanged in September from a year earlier, while overtime pay dropped for the first time in 13 months, suggesting salaries remain under severe pressure. A rise of 0.4% is expected now.

*All times are GMT.

USD/JPY Technical Analysis

$/yen began the week sliding to the 81.80 line (discussed last week). It later recovered rose towards the 82.87 line and eventually closed at 82.47, quite close to last week’s close.

Technical lines from top to bottom

86.27, which served as resistance, also in 2010, is the high point we start at. 85.50 is a high peak seen back in early 2011.

84.20 is a more recent swing high, seen in early 2012. It is followed by 83.34 which capped the pair in April and also beforehand.

82.87 is a veteran line – that’s where the BOJ intervened for the first time back in 2010. The line also capped the pair during November 2012.

81.80 capped the pair in April, and is the level of the “shoulders” in the upwards thrust seen at the time. 81.43 is stronger after serving as resistance for a recovery attempt back in 2011, and capped a move higher in November 2011.

80.70 worked as resistance back in June and in a stronger manner in October. It turns into support now. The round number of 80 is psychologically important, even though it was crossed several times in recent months.

79.70 was a cap was seen in June 2012. It proved its strength as resistance once again in July 2012 and proved critical before the downfall in August 2012. It strengthens again after capping the pair during November 2012.. 79.05 capped the pair in September 2012 and similar levels were seen in the past. Despite being temporarily overrun, the line still matters, especially after working as support in November 2012.

78.80 proved its strength as resistance in August 2012 again and again. The last attempt at the beginning of October should monitored. The round number of 78 is now stronger support after being the bottom of the range and is becoming stronger after working as a cushion also in September 2012.

77.40 was the extended low line in September 2012, until the pair rebounded. It is followed by 77, which is only minor support.

Another Recent Technical View: USD/JPY Rises after Pull Back– by James Chen

I remain neutral on USD/JPY.

We can expect another week of consolidation as the elections in Japan are not close enough. On one hand, Japanese officials talk down the yen. On the other hand, disagreements regarding the fiscal cliff could boost the “risk off” sentiment, which helps the yen more than the dollar. While US GDP was revised to the upside, there are 4 worrying signs why this growth isn’t that good.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast