Dollar/yen continued the push higher, riding on the Japanese government’s determination.Core Machinery Orders and Tertiary Industry are the main events this week. Activity Here’s an outlook for the Japanese events and an updated technical analysis for USD/JPY.

Last week, Japanese Prime Minister Shinzo Abe repeated his agenda for eliminating deflation, calling for bold monetary easing by the central bank, big fiscal spending and an economic growth strategy aimed to boost private investment. Eventually the Japanese government approved a huge stimulus package and the yen continued falling. Will Abe’s strategy prove effective?

Updates: M2 Money Stock jumped 2.6%, an eight-month high. The markets had expected a rise of 2.1%. Preliminary Machine Tool Orders looked dismal, plunging by 27.5%. This marked the sharpest decline since November 2009. Core Machinery Orders looked sharp in December at 2.6%, but the markets are bracing for a steep drop, with an estimate of a modest 0.4% gain. CGPI is expected to improve slightly, with an estimate of -0.7%. The yen has reversed its steep slide, and dropped to the mid-88 range. USD/JPY was trading at 88.48. Core Machinery Orders jumped an impressive 3.9%, crushing the estimate of 0.4%. CGPI declined -0.6 %, just above the estimate of -0.7%. Consumer Confidence looked weak, coming in at 39.2 points. This was well below the estimate of 40.7 points. Tertiary Industry Activity also disappointed, dropping by 0.3%. The estimate stood at 0.1%. Revised Industrial Production will be released on Friday. The yen is down sharply, as the markets expect further easing from the BOJ next week. The pair was trading at 89.52.

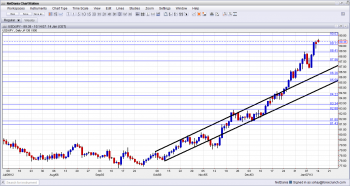

USD/JPY daily chart with support and resistance lines on it. Click to enlarge:

- M2 Money Stock: Monday, 23:50. Japan’s M2 measure of domestic currency in circulation increased less than predicted in November from a year earlier, rising 2.1% after 2.3% rise in October. The reading was lower than the 2.3% increase predicted by economists. The weak rise was mainly due to the sharp growth of 3.0% registered in November 2011. The same increase of 2.1% is expected now.

- Prelim Machine Tool Orders: Tuesday, 6:00. Japanese machine orders declined sharply in November, reaching -21.3$ down from -6.7% in October suggesting investors were anxious about future economic activity in Japan. However economists believe Japan’s economy could recover in the first quarter in case consumer spending and exports improve.

- Core Machinery Orders: Tuesday, 23:50. Japan’s core machinery orders excluding ships and utilities increased 2.6% in October following three months of declines. The increase was less than the 3.0% rise predicted following 4.3% drop in the previous month. Nevertheless, the government reduced its forecast on machinery orders, saying that they are weakening as a trend despite the increase in October. A small rise of 0.4%is forecasted this time.

- Consumer Confidence: Wednesday, 5:00. Japanese consumer confidence continued to deteriorate in November, reaching 39.4 after posting 39.7 in October, a further sign that economic decline worsened consumer sentiment. The reading was below the 40.3 predicted by analysts. A rise to 40.7 is expected.

- Tertiary Industry Activity: Wednesday, 23:50. October service sector activity index dropped 0.1% after posting a 0.2% increase in September. Wholesale & retail trade, ,amusement services, energy related services were among the industries registered declines while transport & postal activities, scientific research, professional & technical services, and learning support increased. An increase of 0.1% is anticipated.

- Revised Industrial Production: Friday, 4:30. Japan’s industrial output increased a seasonally adjusted 1.6% in October, revised down from a preliminary 1.8% rise. Economists expected a reading of 1.8% increase. Electronic parts, metal product and transportation machinery industries increased. A decline of 1.7% is forecasted.

*All times are GMT.

USD/JPY Technical Analysis

Dollar/ ¥ dropped in the wake of the new week and slid to around 86.80. It later recovered in an impressive manner, and after being capped by 88.40 (mentioned last week) it pushed forward and eventually conquered the 89.10 line.

Technical lines from top to bottom

A very important line is 94.70 – which capped the pair for long months in early 2010. 92.12 worked in both direction in 2009 and 2010. These are still in the distance at the moment.

The ultimate resistance line for now is 90 – a target marked by many analysts and a round number. This line is getting very close. Below, 89.10 was a peak in the summer of 2010, before the pair began descending and is now support.

88.40 is the peak of January 2013 and is immediate resistance at the moment. Below, 87.60 provided support on a pullback when the pair traded higher in January, after previously working as resistance.

86.27, which served as resistance, also in 2010 is weakening now. 85.50 is a high peak seen back in early 2011 and remains important support now.

84.20 is a more recent swing high, seen in early 2012. This is now critical resistance for any move forward.An initial move above this line in December 2012 turned into a false break. It is followed by 83.34 which capped the pair in April and also beforehand. It switched to support after the surge in December.

82.87 is a veteran line – that’s where the BOJ intervened for the first time back in 2010. The line also capped the pair during November and December 2012.

Channel Left Behind After Breakout

As the chart shows in the black lines, the pair traded in an uptrend channel since early October. After the breakout seen in the previous week, USD/JPY’s moves just became stronger.

Another Recent Technical View: USD/JPY Ascends to Multi-Year High – by James Chen.

I turn bearish on USD/JPY.

The huge efforts of the Abe’s government are bearing fruit: the stimulus program has been approved, the BOJ understands its delicate position and the yen is weakening. However, and despite the moral currency war, some external pressure could weigh on Japan: the policy of “beggar thy neighbor” has its limits. In addition, some business leaders in the land of the rising sun have also begun saying that the current levels of the yen seem OK. After the big surge, we could see a pullback at the 90 level, and not just a temporary stop.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast