The Bank of Japan convenes on the same day as the Fed. With the Fed not expected to change policy, will the BOJ create its fireworks? Credit Suisse has its doubts:

Here is their view, courtesy of eFXnews:

The BoJ meeting on 20-21 September appears to be attracting more market attention than the Fed meeting also taking place on 21 September. Option markets show a clear premium in USDJPY vol vs. the rest of G10 vol around the two-week tenor coinciding with the BoJ meeting

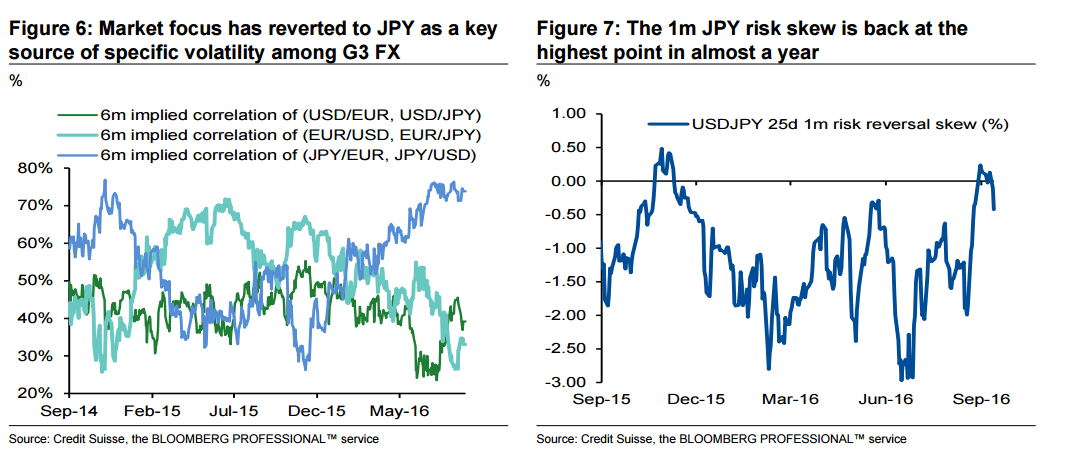

Indications of strong market interest in JPY abound across the vol space. The divergence in implied correlations, with JPY correlation drifting higher suggests markets, are looking at the JPY as a potential driver for FX volatility (Figure 6). At the same time, the front-end tenor USDJPY risk reversal skew has moved close to zero over the course of the past few weeks; pricing USDJPY calls at a near flat premium to USDJPY puts

This sharp increase in demand for optionality around the BoJ meeting and the shift in relative pricing for USDJPY calls vs. puts to the highest point in almost a year suggests the market is approaching the upcoming BoJ meeting with high expectations for a dovish outcome, one that would likely drive spot USDJPY higher. We think these expectations will once again be disappointed.

Our economists are in fact expecting little to no change in policy from the BoJ at the upcoming meeting. Specifically, the spotlight next week is projected to be on the BoJ’s “comprehensive assessment” of its NIRP+QQE policies. Our economics team believes this assessment will be broadly positive, pointing to improved borrowing and investment data as proof of its policies’ success. In the absence of a considerable change in how BoJ officials view their policies, a significant shift in said measures is unlikely.

If anything, our team believes there is a small possibility of a cut in the tier 3 IOER rate from -0.1% to -0.2%, or of a slight upgrade in JGB purchase targets from JPY80tn to JPY80-90tn.

In light of the massive and rapid shift in expectations, we are not convinced that such changes are likely to be viewed as satisfactory about market pricing, particularly in a time when much more aggressive policy options (e.g., direct financing of government spending on infrastructure) are being weighed in the financial press. As such, we see high potential for disappointment and continue to target USDJPY at 95 in three months.

As a technical-based trade, Credit Suisse maintains a short USD/JPY trade from 103.90 targeting 100.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.