Dollar/yen is on the back foot as worries re-emerge in the new quarter. The “risk-off” trade weighs on commodity currencies such as the Aussie and certainly assists the safe-haven Japanese yen.

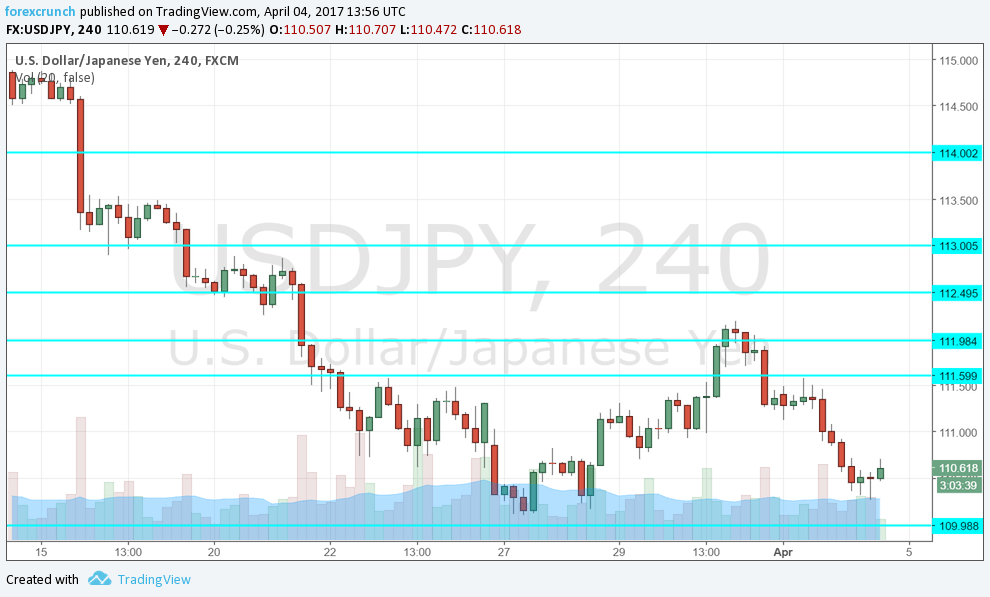

In its descent, USD/JPY hit a low of 110.27. This is close enough to the round level of 110 to be seen as a double bottom. The pair can thus be seen as bouncing off a tough level of support. The same happened with the 111.60 area. It took three sniffs at this cushion before momentum was strong enough for a breakdown.

Or it could be a higher low. If we look closely, the pair bounced off a lower level back in March and now even fails to get really close to 110.

US data determines the next move

A lot depends on the next events in the US dollar as the buildup towards the Non-Farm Payrolls intensifies. So far, the figures have been OK: the ISM Manufacturing PMI saw a drop to 57.2 but the employment component advanced.

The US trade deficit came out narrower than expected at -43.6 billion while factory orders rose by 1% exactly as expected. Nevertheless, tomorrow’s big figures such as the ADP Non-Farm Payrolls and the ISM Non-Manufacturing PMI will already serve to determine the next battle with 110.

Is a breach coming or have we seen the last futile attempt?

More: Hesitant to Short EUR Into French Elections; Short USD/JPY Preferable – Nomura