Dollar/yen suffered on the Trump Dump, but could turn to a new direction. Here is the view from Deutsche Bank:

Here is their view, courtesy of eFXnews:

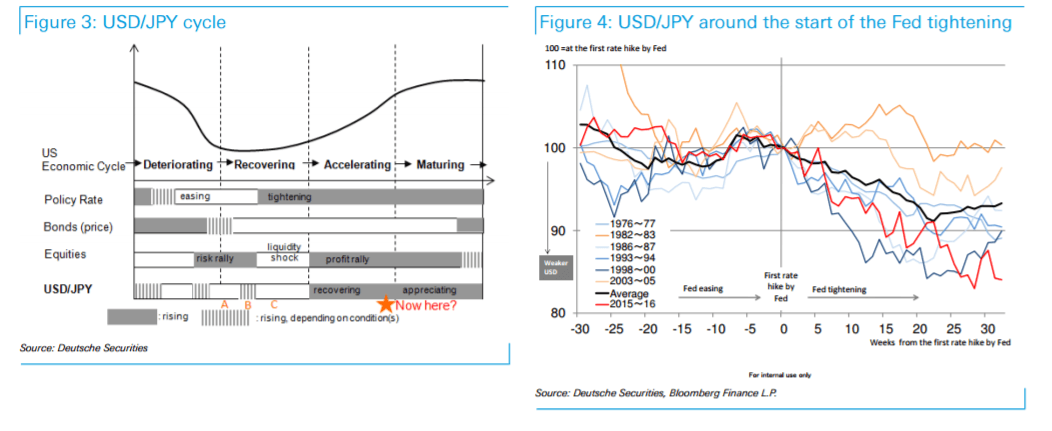

We expect USD/JPY to rise to 120-125 yen (after a near-term correction to 110-115) as US fiscal policy boosts economic growth to 3-4% from late 2017 through 2018, and the Fed hikes twice in 2017 and four times in 2018. We have fielded numerous questions about our view in light of the Trump government’s protectionist stance and the pursuit of a weaker dollar, and the outlook for Fed hikes.

A comparison with 1993-95: Questions focus on the USD/JPY decline in 1993-95 triggered by the tough US stance in trade negotiations with Japan and a rapid series of Fed hikes. However, conditions now differ in many ways to the 1990s. We sum up the key takeaways regarding forex markets in 1993-95. In cyclical terms, this was a typical start to a phase of USD/JPY decline as US rates switched from a downtrend into an uptrend. This was accentuated at every turn by intense US-Japan political friction, the equity and bond selloff and emerging market jitters brought on by inflationary concerns due to the Fed’s rapid hikes, and Japan’s fund repatriation and hedging following the bubble’s collapse. We would also note the market’s shaky confidence in the dollar, a hangover from the “double deficit” rhetoric of the 1980s.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

How is 2017 different? We see the current US economic cycle is running in the latter half which will likely be extended by the aggressive fiscal policy, compared with the early phase of the US economic expansion cycle for 1993-95. We see a dramatic negative impact on US stocks and bonds as unlikely given the limited risk of inflation and the slow prospective pace of Fed hikes. The dollar is the most trusted of any global currency, and Japanese investors are seeking opportunities to buy rather than hedge or repatriate (sell). Politically, we think the US is focused exclusively on reining in China and relations with Japan appear relatively healthy. EM currencies have already experienced a multi-year selloff, and we believe market unease is unlikely to prove as contagious as it was in 2012-15.