Talk about postponing the next hike in Japan’s sales tax have been going on for quite a long time. Earlier this week, the yen was sold off against its peers, with USD/JPY reaching a high of 1.1147.

The tables have turned: USD/JPY crashes and dips under 1110. This may be related to an accompanying slide in stocks, always correlated to Dollar/yen, but it seems like a “sell the fact”.

This is not the first time that the Abe government changes its mind on the sales tax. After he April 2014 hike, Japan fell into a recession. Later that year he decided not to follow with another tax hike and called fresh elections on this. A landslide election was followed with further mixed growth. The Japanese economy has been fluctuating between growth and contraction and another hike could have sent it to a new recession.

The sales tax has been delayed by 2.5 years to 2019 and there are fresh doubts about this as well. It is “data dependent”.

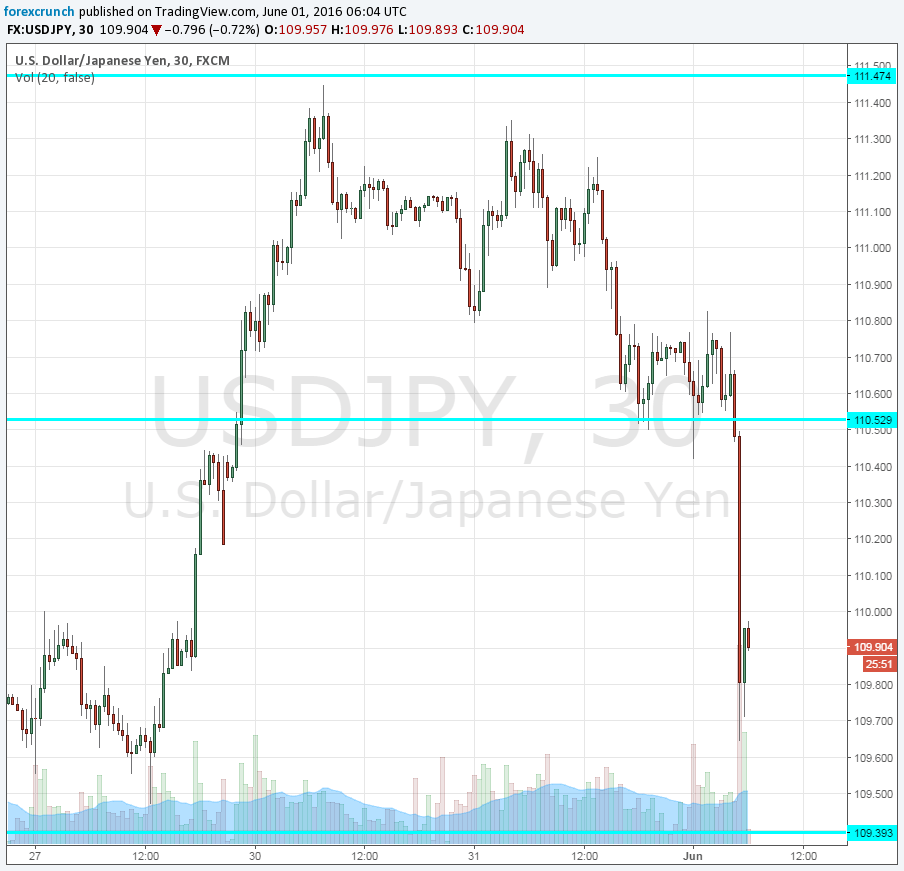

Here is how it looks on the chart, with the pair hitting a low of 109.64 at the time of writing. Further support awaits at 109.40, followed by 108.25. Resistance is restored at 110 and 112.

More: Buying USD and JPY much better choices than EUR in case of a Brexit