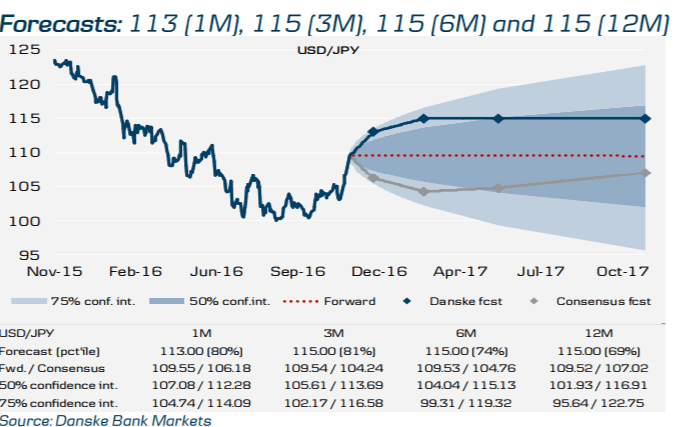

USD/JPY is already topping the 110 level in a move that seems unstoppable. The team at Danske explains the action and sets the next targets:

Here is their view, courtesy of eFXnews:

USD/JPY has rallied significantly since Donald Trump was elected the next US President.

In the short term, we believe USD/JPY is likely to remain supported by improved risk appetite and expectations of a Fed rate hike in December, which we still call for. We lift our targets for USD/JPY to 113 (from 104) in 1M and 115 (from 106) in 3M.

Over the medium term, the case for higher yields on 10-year US treasuries and higher commodity prices has been strengthened by a rise in US inflation expectations, which are assumed to be supportive factors for USD/JPY. Hence, while the underlying JPY appreciation pressure stemming from, among other things, a large current account surplus is likely to remain intact, we expect US reflation to support the case for further portfolio investment outflows out of Japan, which combined with higher FX hedging costs on USD assets is likely to weigh on the JPY. We now target USD/JPY at 115 (previously 106) in 6M and 115 (was 106) in 12M.

For the longer term forecasts, we see risks fairly balanced but stress that uncertainty is unusual high given the many unknown factors for US economic policy under Trump.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.