The US dollar is struggling with the new president but this is most notable with USD/JPY. What’s next? Here is the view from Citi.

Here is their view, courtesy of eFXnews:

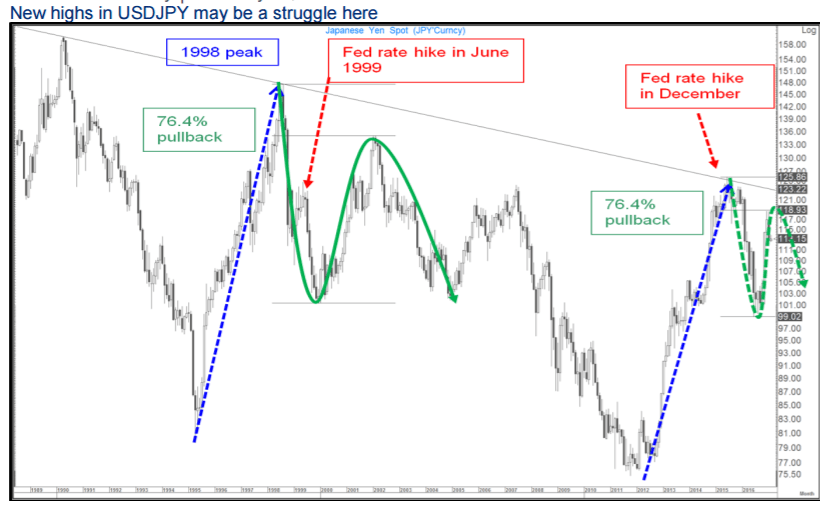

USDJPY looks like it has topped out similar to how it did after the Fed started hiking rates in 1999.

We’ve also held the 76.4% Fibonacci retracement of the fall from the 2015 high, and it is worth noting that that high was posted after we stalled at the long term trendline from the highs going back to 1990, which is presently at 123.96.

Long term Fibonacci retracements have been a good signal in the past and the 76.4% retracement level of the fall from the 1998 high also marked the high of the trend in 2002.

These developments suggest that USDJPY will struggle to make higher highs in the trend even if our medium term USD and US Yields view is correct.

We have set lower lows in the trend in each of the past seven weeks and a continuation of the correction lower should see us test support around 108.90-109.66 where the 55 and 200 week moving averages converge.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.