The Bank of Japan said its word: targeting long-term interest rates. But what does it actually mean? The team at Goldman Sachs sees the Japanese currency coming under pressure:

Here is their view, courtesy of eFXnews:

We are thinking about last week’s actions from the BoJ along two dimensions.

First, we continue to see the substantive changes in a positive light, given that the shift to yield targeting effectively ends the JGB scarcity debate and sets the stage for “QQE infinity.”

Second, the overwhelmingly negative market reaction shows just how much sentiment has turned. The reality is that – with inflation so far below target – markets have no patience for half measures.

We weigh these countervailing forces and makes three points.

First, there is lots of speculation that the fiscal stimulus will help the BoJ meet its inflation forecast. We disagree. Only a substantial weakening of the Yen can do that.

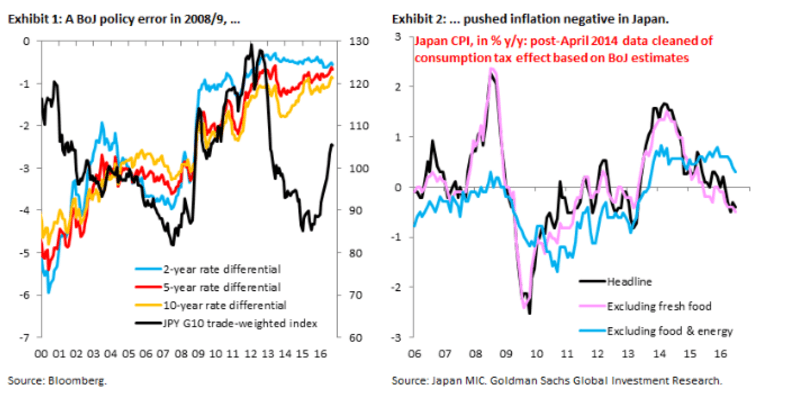

Second, the comprehensive assessment talked a lot about “adaptive expectations,” the fact that the deflation mindset is still strong. All the more reason for the BoJ to keep shocking markets, arguably the intention behind the switch to yield targeting.

Third, the market is looking to punish incrementalism with a stronger Yen. Any sign that the BoJ has given up on aggressive easing could see $/JPY move below 100, threatening to unravel all progress under Governor Kuroda.

Our core view is that there is only one way forward, which is to weaken the Yen.

We continue to see $/JPY at 108, 110 and 115 in 3-, 6- and 12-months, respectively. The main risk is that the BoJ misreads markets and thinks it can stay on hold with $/JPY stable. It cannot. It’s the (Y)ENd game.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.