As 2014 draws to an end, it is time for thinking about the big trades of 2015. The team at Bank of New Zealand (BNZ) has released its outlook, which favors the dollar.

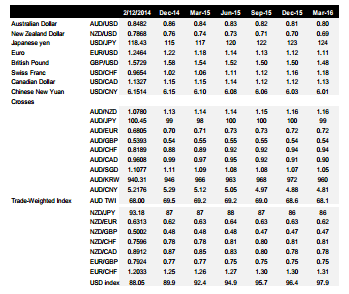

In their key notes, they provide levels for both major pairs and some interesting trades on crosses:

Here is their view, courtesy of eFXnews:

Bank of New Zealand (BNZ) is out with its global FX outlook where BNZ outlines its main strategy, forecasts, and top trades for the year ahead. The following is a summary of the major points in BNZ’s outlook, along with BNZ’s top trades, and forecasts.

2015 Outlook:

We remain unabashed USD bulls, encouraged by the prospect of Fed policy normalisation at some point in 2015, while other major central banks continue to pump liquidity into markets at near-zero rates.

We resist the urge to jump into the camp calling for USD/JPY at ¥140+, on suspicion that GPIF-related flows may be as much behind as ahead of us.

The ECB will continue down the path toward sovereign QE. We fully buy in to Mr. Draghi intent to “raise inflation and inflation expectations as fast as possible.”

Inclement weather and US politics are risks to the bullish USD view; disinflation, not so much.

The AUD TWI still has further to fall to match both past and still-to-come declines in the terms of trade, with AUD/USD to do much of the heavy lifting.

The NZD is picked to underperform its peers, as NZ growth declines from a predicted peak in Q4 2014. Top trade ideas for 2015

2015 Top Trades:

Our top trades incorporate our core USD bullishness, both directly against USD (short EUR/USD and NZD/USD) and on the crosses (short AUD/CAD).

We await better entry levels to short GBP either against the USD or on the crosses, as political risk looms.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.