While hopes are in abundance for a deal on Greece, many suspect that the next crisis could be just around the corner.

Goldman Sachs analyzes the situation in the debt stricken country and assesses what it means for the common currency.

Here is their view, courtesy of eFXnews:

In a special note to clients today, Goldman Sachs discusses the puzzling EUR/USD price action over the past few weeks as Greek tensions have mounted.

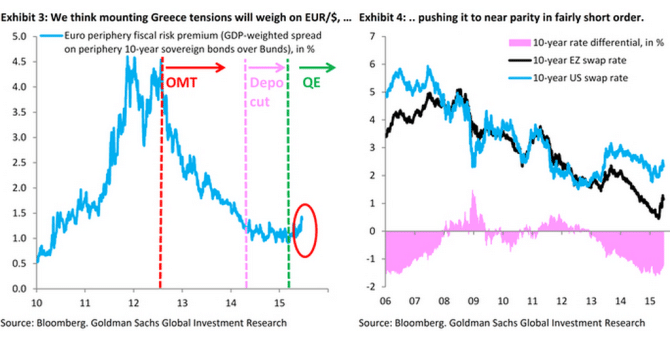

GS argues that much of this price action stems from the Bundesbank, which has reduced the maturity of its QE buying, enabling the Bund sell-off and moving longer-dated rate differentials in favor of the Euro and as such GS thinks that ‘EUR/USD hasn’t traded Greece, but instead growing question marks over ECB QE’.

Here is how how GS discusses what Greece means from an economic perspective and for EUR/USD along with its latest forecasts for the currency pair.

“From an economic perspective, Greece shows that “internal devaluation” – whereby structural reforms are meant to restore competitiveness and growth -is difficult politically and a poor substitute for outright devaluation. Emerging markets that devalue during crises quickly return to growth, powered by exports, while Greek GDP continues to languish. We emphasize this because – even if a compromise involving a debt haircut is found – this will not do much to return Greece to growth. Only a managed devaluation, with the help of the creditors, can do that,” GS argues.

“With respect to EUR/$, we think the Bund sell-off increases EUR/$ downside if tensions over Greece escalate further. This is because the ECB, including via the Bundesbank, would almost surely step up QE to prevent contagion. We estimate that the immediate aftermath of a default could see EUR/$ fall three big figures. The ensuing acceleration in QE would then take EUR/$ down another seven big figures in subsequent weeks,” GS adds.

“We thus see Greece as a catalyst for EUR/$ to go near parity, via stepped up QE that moves rate differentials against the single currency,” GS concludes.

EUR/USD forecasts:

GS maintains its EUR/USD forecasts at 0.95 in 12 months and 0.80 by end of 2017.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.