The mood on Friday deteriorated and US equities closed at fresh lows. We can expect a risk-off start to the week following fresh distribution at the end of last week. The fast-spreading disease that jumped from animals to humans in China has now infected 328,275 people across the world and caused 14,366 deaths, according to Johns Hopkins University.

-

French confirmed coronavirus cases rise to 16,018 – Health Official

-

Coronavirus update: Italy reports almost 800 deaths, Russian army to send military help

-

German Chancellor Merkel in quarantine after contact with doctor that tested positive for coronavirus

For a market wrap on Friday, see here: Forex Today: Coronavirus pandemic continues to back risk-off. However, in the US, the S&P 500 closed off 4.3% and the Dow down 4.6%. Owing to the negative growth implications of the restrictions, US fixed income rallied. The yield on the US 10-yr note fell 30bps to 84.5bps. Gold climbed 1.6% to $1,498.7/oz. Markets have suffered losses unseen since the 2008 financial crisis and the world’s policymakers and governments are trying to stabilize economies suffering from the impact of quarantined consumers and disrupted supply chains.

-

Fed’s Bullard: Says Fed willing to do more to assist with crisis

St. Louis Federal Reserve President James Bullard crossed he wires this weekend and said a potential $2.5 trillion hit is coming to the US economy as the world’s richest nations pour unprecedented aid into the global economy with coronavirus cases ballooning in the new epicentre, Europe, with the number of deaths in Italy outpacing those in mainland China, where the virus originated. With the world on lockdown and practising social distances, curfews and outright travel bans, there will be a focus on a deteriorating global economy this week and particularly the labour market where lay-offs, everywhere, are rising alarmingly. “Initial claims will soar and could rise by 5-10 million workers in the next few weeks with risks to the topside. As Europe locks down more stringently, services and production disruption is spiralling. Australia has just closed all pub/entertainment/indoor sport venues for six months (dining takeaway only); the shutdown in NSW and Victoria is even tougher,” analysts at ANZ explained.

-

G20 Finance Ministers will hold teleconference at 1100GMT on Monday March 23

UN chief Antonio Guterres recently warned that a global recession, “perhaps of record dimensions”, was a near certainty.“This is a moment that demands coordinated, decisive, and innovative policy action from the world’s leading economies,” Guterres explained to reporters via a video conference. “We are in an unprecedented situation and the normal rules no longer apply.”

It is probably fair to say that the usual market drivers in fundamentals will take a back seat to the spread of the virus and daily updates of it and governmental responses. Volatility is here to stay in the FX space and it is worth noting that there is still plenty of downsides to go should markets continue to shake out the bulls towards the GFC lows, which are some 70% away in the S&P 500, for instance. Markets will be looking out for the headlines from the G20 Finance Ministers who will hold a teleconference tomorrow at 1100GMT. The US dollar could be expected to remain bid in a flight to liquidity and cash.

-

Breaking: RBNZ announces quantitative easing

Eyes on gold prices as it enters a net sort position

We are also seeing the reverse in gold, as trend followers are set to target a net short position in gold for the first time in nearly a year as stimulus packages become larger as the severity of the recession unfolds. Just today, the Reserve Bank of New Zealand announced that it would conduct large-scale asset purchases of New Zealand Government bonds (‘quantitative easing’, or ‘QE’), following similar moves by global central banks last week.

“For now, with interest rates already at the zero bound, real rates are soaring as deflationary pressures more than offset the Fed’s actions — keeping pressure on gold as a result,” according to analysts at ANZ Bank who explain that CTA selling pressure is adding weight on prices in the yellow metal, “as trend followers are set to target a net short position in gold for the first time in nearly a year. However, a close north of $1515/oz could through a wrench in the momentum signals and whipsaw the algos in the process. For the moment, we don’t expect significant flow from trend followers elsewhere in the complex.”

-

Gold Price Analysis: Holding onto $1,493 critical to recovery in another corona-clouded week

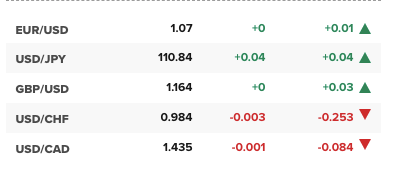

CNBC’s pre-open FX prices