Eurozone flash CPIs estimate overview

Eurostat will publish the Eurozone’s inflation first estimate for May at 09.00 GMT today. Consumer prices are seen accelerating to 1.6% on a yearly basis while the core figures are expected to rebound to 1.0% in the reported month.

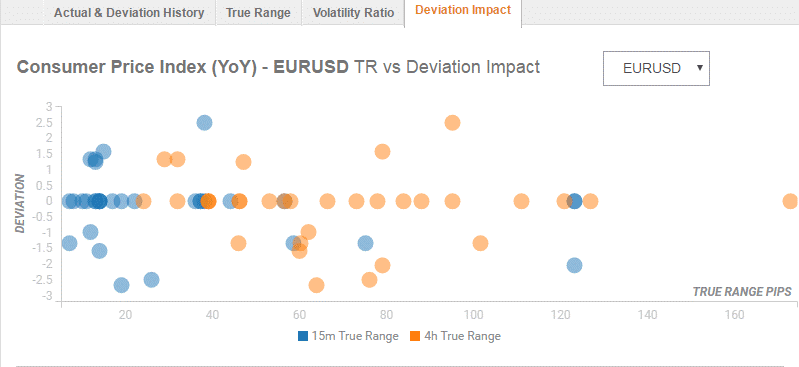

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 40 pips in deviations up to 1.5 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 50 pips.

How could affect EUR/USD?

Haresh Menghani, Analyst at FXStreet explains, “any meaningful retracement is likely to find immediate support near the 1.1625-20 region and is closely followed by the 1.1600 handle, below which the pair is likely to head back towards challenging the key 1.1500 psychological mark with some intermediate support near the 1.1535 area. Alternatively, a convincing move beyond the 1.1700 handle would negate near-term bearish bias and trigger a fresh bout of short-covering move, which could lift the pair initially towards 1.1740-45 supply zone en-route its next major hurdle near the 1.1785-90 region.”

Key Notes

European FX Outlook: The Eurozone inflation is set to pick up in May on oil prices

Eurozone: the May inflation rate may spring a surprise – Commerzbank

About Eurozone flash CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).