Canadian CPI Overview

Friday’s economic docket highlights the release of Canadian consumer inflation figures for the month of July, scheduled to be published at 1230 GMT. Consensus estimates anticipate headline CPI to hold steady at 2.5% y/y in July, with the core Bank of Canada measure seen rising 1.3% y/y rate.

According to Analysts at TD Securities: “Energy prices should provide a tailwind on gasoline and warm weather, while currency depreciation and new tariffs on US imports will support other categories. BoC measures of core inflation should hold near 2.0% on average though we see scope for exclusion-based core measures to move higher. International securities transactions for June will be released alongside CPI.”

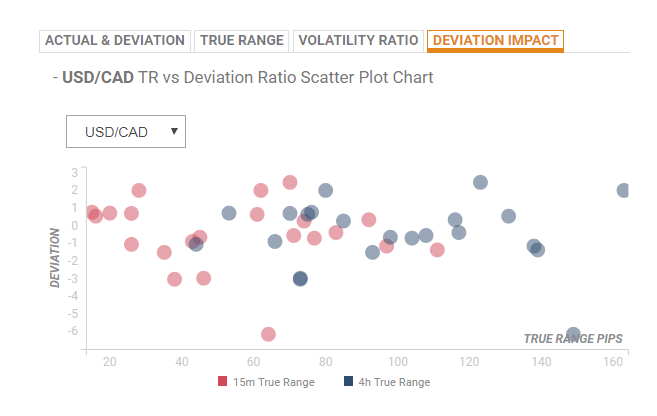

Deviation impact on USD/CAD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction on the pair is likely to be around 26-pips during the first 15-minutes and could get extended to 45-pips in the following 4-hours in case of a relative deviation of -1.02.

How could it affect USD/CAD?

Omkar Godbole, Analyst and Editor at FXStreet explain: “A close today above 1.3180 would confirm a bull flag breakout and open the doors to 1.4040 (target as per the measured height method). On the way higher, the currency pair could encounter stiff resistance at the yearly high of 1.3386.”

“The stacking order of the three major MAs (50-day below 100-day below 200-day) is also favorably disposed towards the bulls. Only a monthly close below 1.2857 (June low) would abort the long-term bullish view,” he adds further.

Key Notes

“¢ Canada inflation to rise 0.1%

“¢ USD/CAD Review: Remains capped near descending trend-channel hurdle ahead of Canadian CPI

About BoC’s Core CPI

Consumer Price Index Core is released by the Bank of Canada. “Core” CPI excludes fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation, and tobacco products. These volatile core 8 are considered as the key indicator for inflation in Canada. Generally speaking, a high reading anticipates a hawkish attitude by the BoC, and that is said to be positive (or bullish) for the CAD.