UK GDP Overview

The Office for National Statistics (ONS) will release final readings of the second quarter (Q2) UK GDP numbers at 06:00 GMT on Wednesday. Although market forecasts suggest confirmation of the initial -20.4% QoQ and -21.7% YoY data, GBP/USD traders await any miss from the data to trim the early-Wednesday losses.

Considering the recent recovery in monthly GDP figures, Westpac says,

Final Q2 GDP will confirm a record drop, with minimal revisions expected from the first estimate of -20.4%. We have already seen July GDP, which was up 6.6%, trimming the decline since February to -11.7%.

As a result, the economic outcome is more likely to be a non-event unless marking any major deviation from the forecasts.

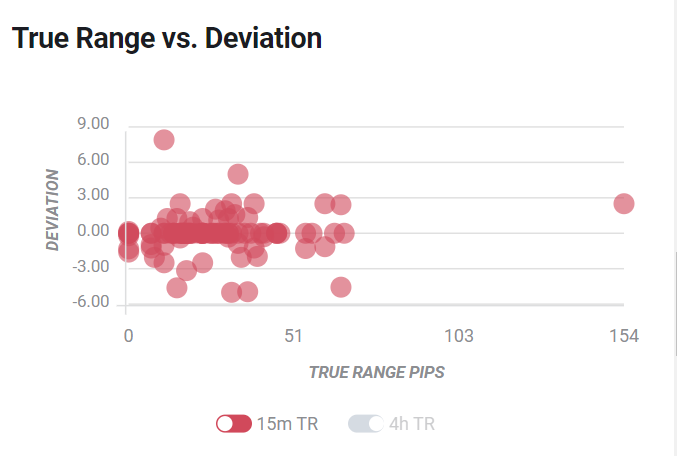

Deviation impact on GBP/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could it affect GBP/USD?

At the time of press, the pre-London open trading on Wednesday, GBP/USD refreshes the intraday low while declining to 1.2836, down 0.22% on a day. The Cable recently bears the burden of the US dollar swing on fears of delay in the American election results that indicate higher odds of a Democratic victory. Even so, the pair stays positive on weekly candle amid hopes of a Brexit deal between the European Union (EU) and the UK.

Given the recent weakness of the pair, any more disappointment from the British GDP data, other than already known, might not refrain from recalling the bears. Also likely to weigh on the quote could be the recent passage of the Internal Market Bill (IMB) in the UK’s House of Commons.

Technically, the quote’s reversal from 100-bar SMA on the four-hour chart, at 1.2860 now, can be challenged by the 50-bar SMA level of 1.2800 and multiple support zone near 1.2775/70, comprising lows and highs marked since September 11. Meanwhile, an upside clearance of 1.2860 can recall 1.2900 and the weekly top near 1.2934 back to the chart.

Key notes

GBP/USD Price Analysis: 100-bar SMA guards immediate upside towards 1.2900

GBP/USD Forecast: Getting mixed clues from Brexit, negative rates

About the UK Economic Data

The Gross Domestic Product (GDP), released by the Office for National Statistics (ONS), is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).