US ISM Manufacturing PMI overview

The Institute of Supply Management (ISM) will release its latest manufacturing business survey result at 1400 GMT this Monday. Consensus estimate point to a slightly lower reading of 59.5 for July, down from previous month’s four-month high level of 60.2.

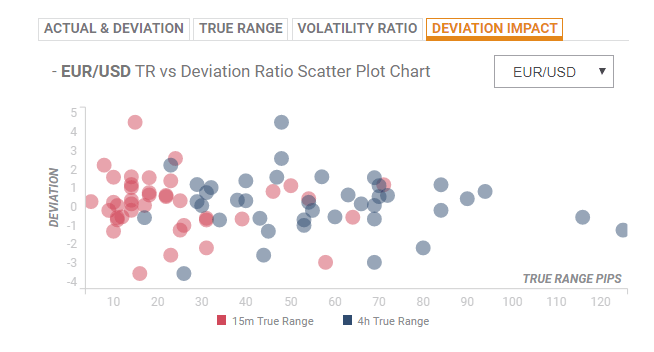

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction in case of a relative deviation of 0.81 or higher is likely to be in the range of 29-pips in the first 15-minutes and could stretch to 56-pips in the following 4 hours.

Alternatively, a deviation of -0.73 or less could move the pair lower by 29-pips in the first 15-minutes and by about 64-pips in the subsequent 4-hours.

The market reaction, however, is expected to be rather muted this time as investors might refrain from placing any aggressive bets ahead of the key event risk – the latest FOMC monetary policy decision, due to be announced later during the New-York trading session.

How could it affect EUR/USD?

Yohay Elam, FXStreet’s own Analyst explains, “1.1665 separated ranges in late July. Lower, 1.1620 was a trough in late July. Lower, 1.1575 was a low point in the middle of the month. The 2018 low of 1.1508 is next.”

“1.1750 is a double top and also was a high point in mid-July. 1.1795 is the peak during July. Higher above we find 1.1850, the peak that was seen in mid-June,” he adds further.

Key Notes

“¢ How to trade the US ISM Manufacturing PMI with EUR/USD

“¢ US: Manufacturer sentiment in July likely remained elevated – Nomura

“¢ EUR/USD Technical Analysis: Spot struggled at the resistance short-term line around 1.1735

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).