This afternoon Big Ben speaks again. Bernanke testifies at 4PM at the Hill. Yesterday EUR/USD was on the run, but without anything important happening. The market waits for the news today from Washington. The one million dollar question is still. Tapering or not tapering?

My bet is that nothing is going to change during the summer, but the FED will probably taper bond buys in the fall, and I am only interested at the interpretation of the market, not the analysts. We do believe that the FOMC will slow the monetary stimulus – for sure. The only question is when. The consensus on the market is for the Fed to taper quantitative easing in September.

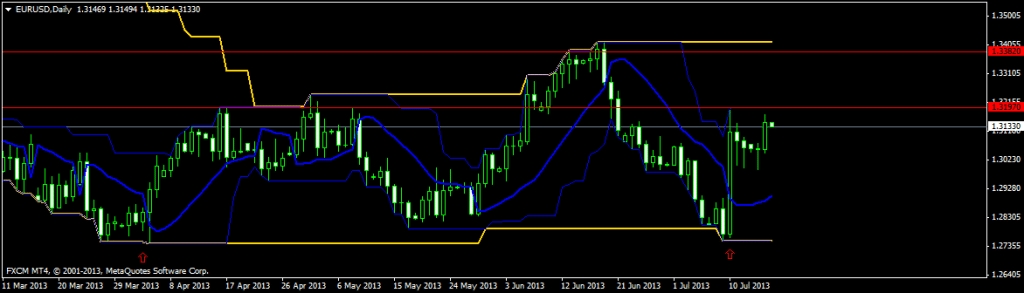

We see the dollar weakening and are expecting EUR/USD to reach 1.3380 within two weeks. Technically, on the daily chart yesterday the pair tested the 1.3050 level and bounced back up to 1,3170. We have a double bottom 1.2755 that is still a huge resistance. We see an upside strength and our target is at 1.3380, but before that the EURUSD needs to break the 1.3200 resistance today after Bernanke’s speech.