EUR/USD seems to return to its “Teflon” status and shrug off bad economic indicators, news about Greece, etc. Can it last for a long time?

The team at Nomura explains what is going on and how it could change soon:

Here is their view, courtesy of eFXnews:

In a note to clients today, Nomura discusses the break in correlations between the Euro and Greek news over the last few sessions (especially Friday and Monday).

“It is too early to say that the correlation has really flipped, and a final collapse in negotiations on Thursday, and subsequent capital controls are still most likely to see the Euro trade lower. But the bigger picture is that Greece matters less and less (and the domino theory is likely to be proved wrong in an actual Grexit-type scenario),” Nomura argues

Why is the Euro holding in? Nomura outlines at least three possible interpretations:

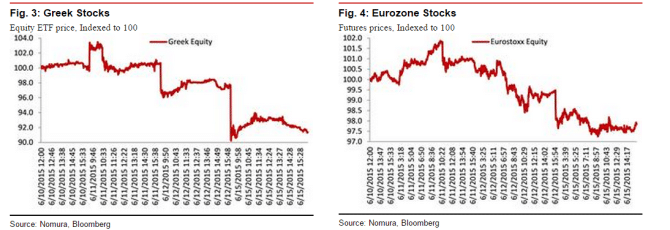

1) Noise is at play. “One interpretation is that the Greek news is feeding into the Eurostoxx and peripheral spreads in a fashion consistent with past correlations, and that EUR will soon follow. In other words, the price action in recent days in FX space is noise, which should be ignored, as old correlations will re-establish themselves soon,” Nomura clarifies.

2) Greece itself ultimately does not matter too much to EUR. “In a world where contagion effects can be controlled though the enhanced backstop infrastructure (ESM, OMT, QE). In this world, ending the Greek drama may remove some uncertainty, and perhaps support the Euro on the margin (if there are second-round effects; in terms of political contagion to other countries, that is a different matter, but we have not seen much of that),” Nomura adds.

3) EUR is the new JPY. “This means that risk aversion is increasingly supportive of the Euro. This makes conceptual sense, since the Eurozone has the world’s lowest interest rates (excluding the smaller European economies),” Nomura argues.

EUR/USD into FOMC:

“We still think the FOMC will be USD supportive on the margin (especially now that short dated Euro-dollars have rallied into the event). Hence, we are sticking with a long USD bias into the event in short EURUSD form. We will re-evaluate after the meeting,” Nomura advises.

The trade: staying short EUR/USD:

Nomura maintains a short EUR/USD from 1.1220 targeting a move to 1.09.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.