The Greek situation is very worrying, with days left to find a resolution as banks remain shut and the economy grinds to a halt.

So why is the euro stable? The team at Bank of America Merrill Lynch

Here is their view, courtesy of eFXnews:

In a note to clients today, Bank of America Merrill Lynch looked at key EUR determinants and discussed the reasons behind the current resilience of the single currency and its outlook for the rest of the year.

Widow-maker is back?

“Life has not been easy for Euro bears. Shorting the Euro was a “widow-maker” in the years before May 2014. It was one of the best FX trades from May 2014 to March 2015. And it has been going nowhere since then, with EUR/USD stuck in a narrow range. More recently, the Euro has remained relatively resilient, despite a substantial deterioration of the situation in Greece,” BofA notes.

Why the EUR is not weakening?

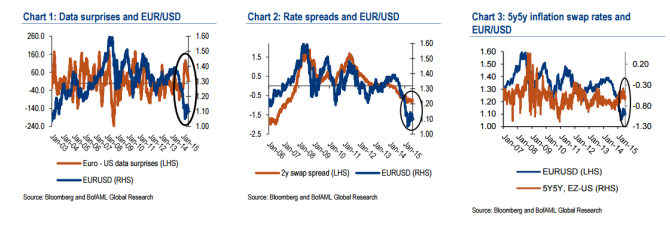

1- The current EUR/USD level is actually consistent with data. “Looking at historical correlations of relative data, it is hard to justify a weaker Euro; in fact, quite the opposite. Although relative data surprises have recently started turning to the favor of the US, they are still consistent with a stronger Euro (Chart 1),” BofA clarifies.

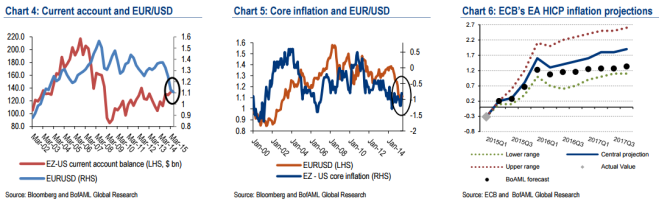

“Short-term rate differentials would also justify EUR/USD well above current levels (Chart 2); and similarly, inflation expectations (Chart 3). The relative current account balance and relative core inflation are consistent with the current EUR/USD level (Chart 4 and Chart 5),” BofA adds.

2- The Eurozone is not Japan. “To a large extent, the Euro has strengthened since Q1 and remained resilient more recently because of the unwinding of positions for Japanisation of the Eurozone economy. When the ECB started QE, many investors were expecting that the Eurozone economy would be like the Japan of the past 20 years, suggesting deflation and QE for years to come. Indeed, our economists had written a report arguing that the Eurozone could not afford a Japan scenario,” BofA argues.

3- The Fed does care about the USD. “An also important reason that the Euro has strengthened since Q1 is that the Fed has pushed against the strong dollar, especially after the March FOMC meeting,” BofA adds.

We still expect EUR/USD at parity by year-end.

“We believe that divergence of monetary policies is a more powerful EUR driver than Greek risks. We remain bearish EUR/USD, although uncertainty around the Fed is not bolstering our conviction levels. We see negative EUR risks in the short-term. We still expect EUR/USD at parity by the end of the year,” BofA projects.

Room to rebuild short EUR positions.

“Our view remains that tail risks in Greece are negative for the Euro. We have also argued that negative net supply should bring Bund yields down in July, also weighing on the Euro. And our positioning analysis suggests that hedge funds are now long EUR for the year and therefore have room to re-establish short positions,” BofA advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.