EUR/USD had two weeks of rises, in a high volatility environment. Can it continue rising? The team at CIBC remains bearish on the euro.

They also offer their opinions on risk and the Japanese yen.

Here is their view, courtesy of eFXnews:

The following are the weekly outlooks for the EUR and JPY as provided by CIBC World Markets.

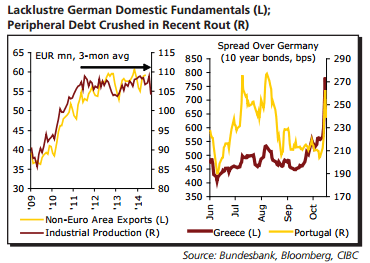

EUR: Recent data has focused attention on weakening German fundamentals which may lead the Bundesbank to acquiesce to more aggressive ECB action. But the fact remains that both industrial production and exports to non-eurozone countries””i.e. exports whose competitiveness would be influenced by the exchange rate””have failed to make any headway in over two years.

That kind of stagnation should be enough to sway German policymakers, while the recent, and dramatic, selloff in peripheral bonds highlights the fragility and illiquidity of non-core European debt markets. Increasingly likely action from President Draghi is a reason why we remain euro bears.

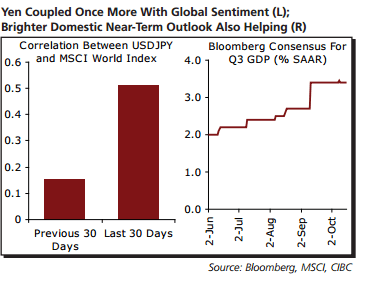

JPY: The Japanese economy faces enough problems of its own, and uncertainty over how it’s coping with April’s consumption tax hike had previously led to speculation of further policy easing that weakened the yen. However, global troubles appear to have trumped those, and the yen has rallied in recent weeks on the back of risk-off sentiment and modest improvement in the near-term outlook in Japan.

If global sentiment turns brighter, expect USDJPY to retrace the recent move back up to around 110. However, a sell-off in the yen beyond that may be a bit further away, with projections for solid GDP growth to be announced for Q3 allaying some of the earlier fears regarding the domestic economy.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.