After the big Draghi disappointment, an easing of monetary policy that didn’t meet the expectations created by the man himself sent EUR/USD 400+ pips higher, the Draghi show is back.

What can we expect? Here are views from Nomura and Barclays:

Here is their view, courtesy of eFXnews:

Nomura:

We do not expect the ECB to make any changes to its monetary policy stance so soon after the 3 December easing. Despite the disappointment of the last meeting, the monetary policy Account does leave options open for more ECB easing, and there were no indications that -30bp represents any threshold for the deposit rate in the Governing Council’s thinking. The possibility of expanding the monthly pace of purchases, frontloading purchases, and extending the APP beyond the suggested six months to March 2017 was also raised.

The upcoming 21 January meeting will therefore be important for assessing the tolerance level within the Council to significant weakening in the short-term inflation outlook that is evolving, and the earliest point at which the ECB is willing to make a “reassessment” on further easing. In addition to monetary policy divergence, we see international flows also having become more EUR negative in the medium term, and we expect fixed income outflows to remain strong in the euro area this year.

Barclays:

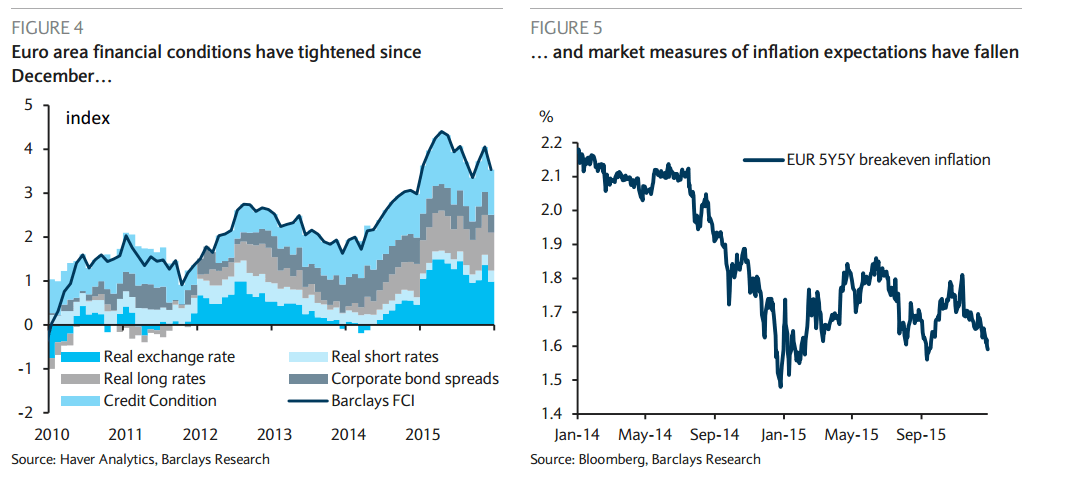

The ECB January meeting and press conference (Thursday) are the most important events for the EUR this week, and while policy settings are widely expected to remain unchanged, dovish rhetoric should place downward pressure on the currency. In the statement and press conference, the ECB is likely to show concern with the tightening in financial conditions that has occurred since its December meeting (Figure 4), including 5% EUR NEER appreciation. This dovish message is likely to be reiterated by President Draghi and Executive Board Member Cœuré when they speak at the World Economic Forum in Davos, Switzerland on Friday. With EA core inflation and market measures of inflation expectations remaining extremely low (the EA 5-year forward, 5-year breakeven inflation rate is about 1.6%, versus above 1.8% in early December, Figure 5), we continue to think longer or greater policy accommodation is likely, which should weigh heavily on the EUR.

Indeed, we now expect euro area inflation to return to negative territory between February and July 2016, picking up thereafter as a result of base effects, but averaging only 0.1% y/y for the year as a whole (vs. 1% in the ECB’s December projections). This would put pressure on the ECB to announce another round of monetary easing measures. However, new measures, including further QE and/or deposit rate cuts, are unlikely to be deployed before June, unless there is another bout of euro appreciation or a further significant drop in inflation expectations.

We look for EURUSD to trade sideways in the near term, but vol-adjusted EURUSD puts are trading at their cheapest level relative to calls in over six years, offering a compelling opportunity to express EUR downside through options. We continue to forecast EURUSD trend depreciation in the coming quarters.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.