After the CPI read was quite poor, some expect the RBA to cut interest rates in Australia. Will they or won’t they? And what’s priced in?

Here is their view, courtesy of eFXnews:

While the risk of a cut at next week’s meeting has increased meaningfully, we keep in mind various factors that may encourage the RBA to wait:

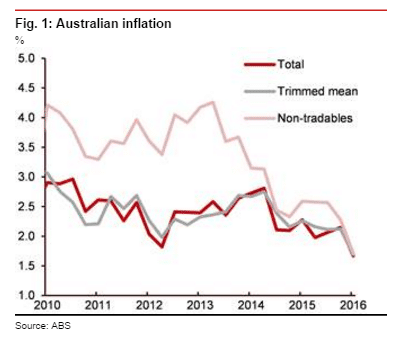

1. Most of the deceleration in inflation in Q1 can be traced to a decline in tertiary education costs, domestic holidays and accommodation, home purchases (likely due to moderating house prices) and electricity. All these are also components of non-tradable price inflation. This suggests that deflationary pressures on the quarter were not broad-based. However, it does not change the moderating trend in inflation.

2. RBA Governor Stevens has said in recent speeches that monetary policy may have reached its limits, saying that “monetary policy alone is not enough to spur growth.” He has been hinting for some time at a preference for some fiscal stimulus.

3. The Commonwealth government is scheduled to release its 2016 Budget only a couple of hours following the RBA’s rate decision. The RBA may decide to delay cutting rates until after the publication of the Budget to evaluate its impact on the economy. This is even more relevant now that there is increased expectations that the government is likely to announce increased fiscal spending in infrastructure ahead of the likely early elections in July, which should provide some support to the economy.

The high likelihood of a rate cut next week will mean that AUD is likely to continue to remain on the back foot going into the RBA meeting. If the RBA cuts rates, AUD is likely to depreciate. However, if it stays on hold and there are signs that the fiscal stimulus will be sufficient to prevent a rate cut, AUD may rally significantly.

The recent history of CAD following the January BoC meeting could provide a template for the reaction in AUD.

However, in the medium term, we continue to view that AUD is at risk, as iron prices are at risk of a correction.

Nomura targets AUD/USD at 0.71, 68, and 0.67 by the end of Q2, Q3, and Q4 respectively.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.