- WTI adds to Wednesday’s gains and approaches $57.00.

- Hopes on US-China trade deal sustain prices.

- Weekly EIA report coming up next in the docket.

Prices of the barrel of the West Texas Intermediate are extending the weekly upside, adding to recent gains near the $57.00 mark.

WTI up on trade optimism, looks to EIA

Crude oil prices are advancing for the second straight session and keep the upside momentum unchanged following Wednesday’s strong rebound from the sub-$53.00 area.

Traders’ mood has markedly improved in past hours after Russian officials said the country would likely reduce its oil output this month, while further upside came after the US could exert further pressure on Iran.

Today, news that US and Chinese negotiators could resume trade talks early next month in Washington has sustained further the upbeat sentiment around crude oil.

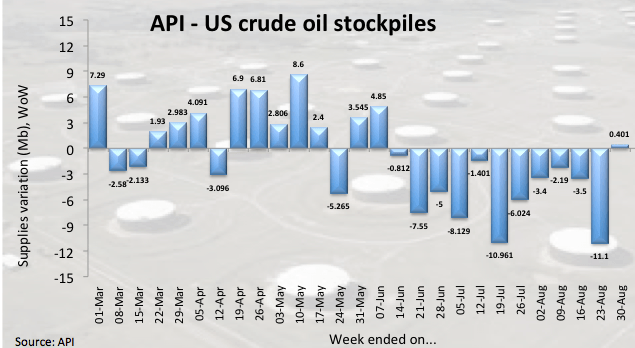

In the docket, the EIA will publish its weekly report on US crude oil inventories later today will the API reported a 401K build during last week. In addition, driller Baker Hughes said US oil rig count dropped by 12 during last week, taking US active oil rigs to 742.

WTI significant levels

At the moment the barrel of WTI is gaining 1.62% at $56.90 and a surpass of $57.57 (100-day SMA) would aim for $58.73 (high Jul.31) and then $60.86 (monthly high Jul.15). On the downside, immediate contention emerges at $52.85 (monthly low Sep.3) seconded by $51.46 (61.8% Fibo of the December-April rally ) and finally $50.54 (monthly low Jun.5).