- WTI bulls in control at the start of the week, brushing off Asian risks.

- Bulls are encouraged b the world’s economic recovery prospects and stronger demand outlook.

After prices fell earlier due to surging coronavirus cases in Asia and underwhelming Chinese manufacturing data. West Texas Intermediate (WTI) has turned bid at the start of the week.

WTI has been climbing from a low of $64.86 to reach a high of $66.40 lifted by European economic reopenings and rising US demand.

In the futures markets, Brent crude finished the session up 75 cents, or 1.1%, at $69.46 a barrel and WTI ended up 90 cents, or 1.4%, higher at $66.27.

As for covid reopenings, there are accelerating vaccination rates in both France and Spain which have relaxed COVID-related restrictions.

Portugal and the Netherlands have also eased travel restrictions. The UK economy has reopened as well after a four-month COVID-19 lockdown.

The demand side is benefitting from the easing of global lockdowns and on such news that United Airlines have announced it will add 400 daily flights to July for European destinations.

On the other side of the scale, however, investors remained worried about the coronavirus variant first detected in India.

Also, China’s factories slowed their output growth in April and Retail Sales significantly missed expectations.

All in all, the global recovery is expected to translate into a large demand story over the coming summer months.

”Further gains for petroleum products could still set the stage for another leg of crude oil strength in the coming months,” analysts at TD Securities argued.

”In this context, while OPEC+ may continue to unwind their extraordinary supply curtailments, a continued cautious approach could still see prices overshoot for a period of time. However, the massive scale of OPEC’s spare capacity suggests that a break north of $70/bbl is not sustainable.”

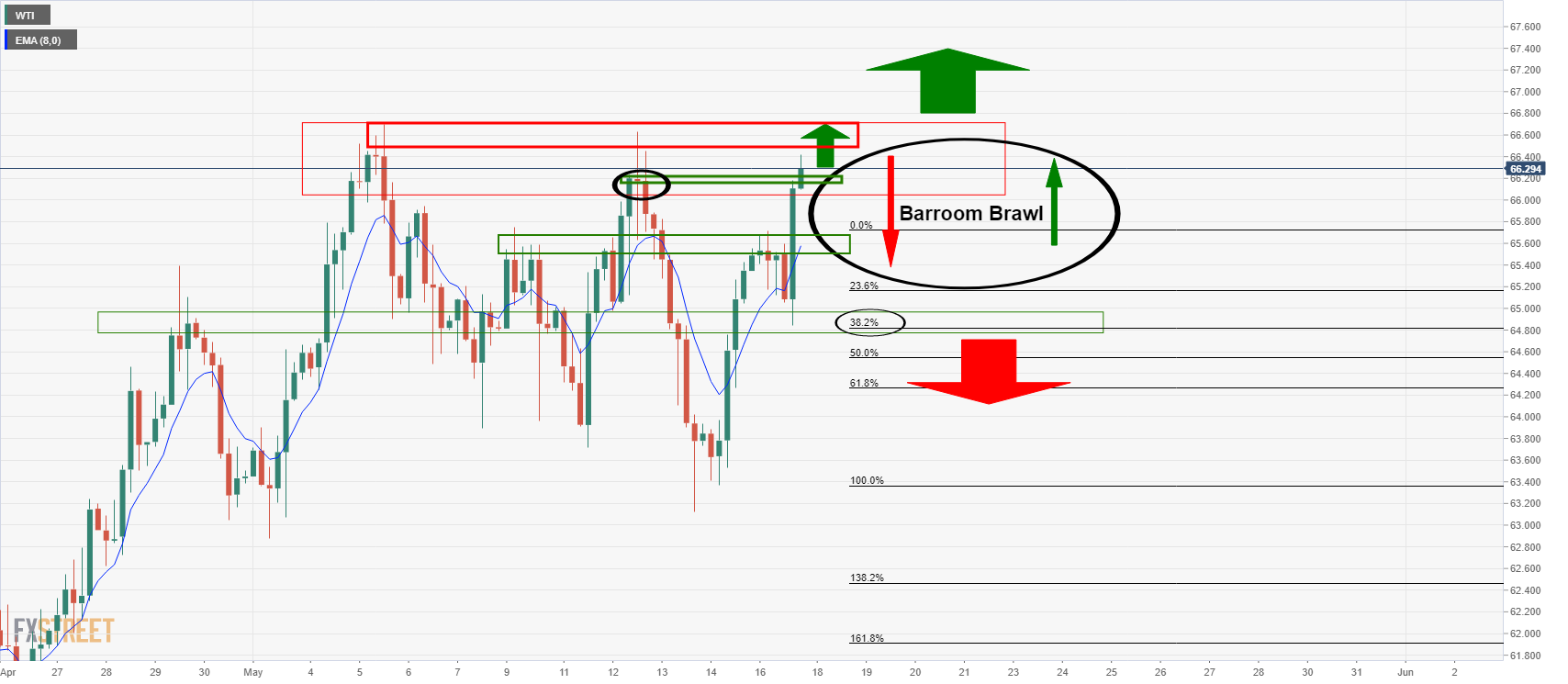

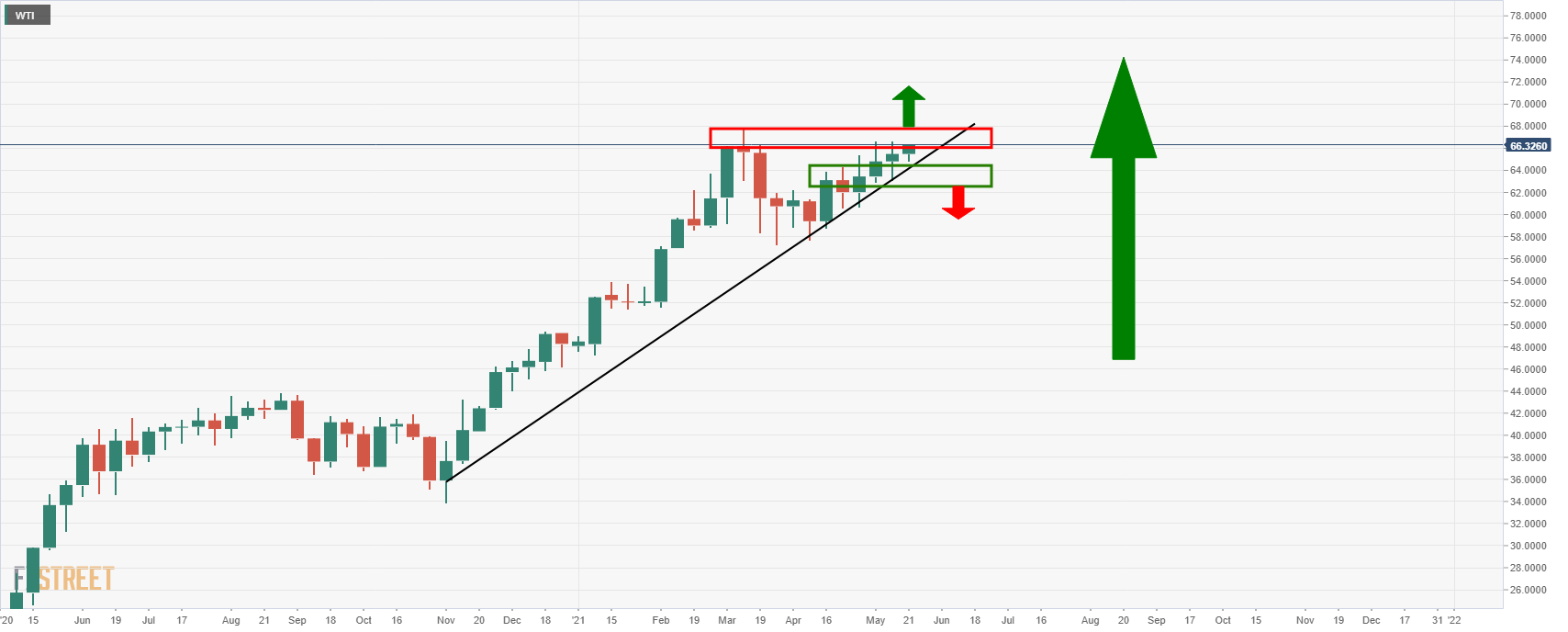

WTI technical analysis

From the above daily and 4-hour charts, it is illustrated that the price can extend higher to test the prior highs, although the price is trapped between daily support and resistance, aka, within the ‘barroom brawl’ zone.

Traders will have a higher probability set up, one way or another, once the price has moved out of the ‘barroom brawl’ zone.

Meanwhile, the bias is bullish above weekly support within the longer-term bull trend: