- WTI recaptures the 21-DMA, helped by the risk-on mood.

- Rising US crude stocks, OPEC+ uncertainty to keep sellers hopeful.

- All eyes remain on the EIA crude inventories, US macro news.

WTI (futures on NYMEX) has turned positive for the first time in four days on Wednesday, as the corrective pullback from yearly highs of $63.71 seems to have stalled.

The risk-on market profile is boding well for the higher-yielding oil, helping it recoup some of this week’s losses. Expectations of a quick global economic turnaround, amid rapid rollout of the covid vaccines, boost the investors’ sentiment.

Although the bulls remain wary amid an unexpected build in the US crude stockpiles, as reported by the American Petroleum Institute (API) late Tuesday. The API data showed that the US crude stocks rose by 7.4 million barrels in the week to Feb. 26 vs. expectations for a draw of 928,000 barrels.

At the time of writing, the US oil trades at $59.98, adding 0.40% on the day.

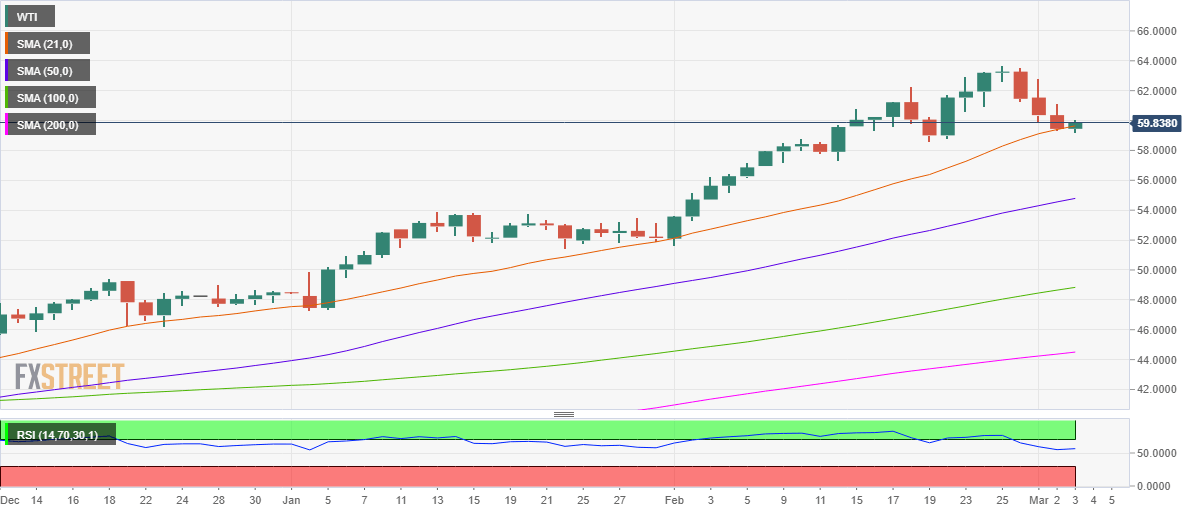

Looking at the daily chart for the WTI barrel, the bulls are defending the critical short-term support of the 21-daily moving average (DMA) at $59.64.

A daily closing below that level could negate the uptrend in the near-term, calling for a continuation of the corrective declines.

The next relevant support is seen at the February 21 low of $57.32.

The 14-day Relative Strength Index (RSI) has turned higher while holding above the midline, suggesting that a bounce towards the $61 mark could be in the offing.

The next direction in the prices hinges on the US crude stocks change data due to be published by the Energy Information Administration (EIA) later this Wednesday.

Also, the US ADP jobs and ISM Services PMI could have some bearing on the USD-sensitive oil.

The main event risk for this week remains the OPEC and its allies (OPEC+) meeting due on Thursday, with tensions mounting, as markets expect the alliance to announce an increase in the oil output amid improving global economic outlook.

WTI daily chart

WTI additional levels