- Prices of the WTI lose the grip and test the $37.00 area.

- Dollar strength, demand concerns weigh on the commodity.

- API, EIA reports due later in the week (Wednesday and Thursday).

Prices of the barrel of West Texas Intermediate are extending the downside to levels last seen in late June in the $37.00 neighbourhood.

WTI weaker on demand, USD

The barrel of the American reference for the sweet light crude oil is down for the fifth consecutive session on Tuesday, extending the leg lower to levels last traded in late June around the $37.00 mark.

Fresh demand concerns have re-surfaced on the back of the strong pick-up in coronavirus cases around the world, which threatens to undermine the ongoing economic recovery. In addition, the persistent move up in the greenback has been also collaborating with the selling sentiment in the commodity in past sessions.

In light of the sharp pullback, it is worth noting that prices of the WTI already shed more than 15% so far this month.

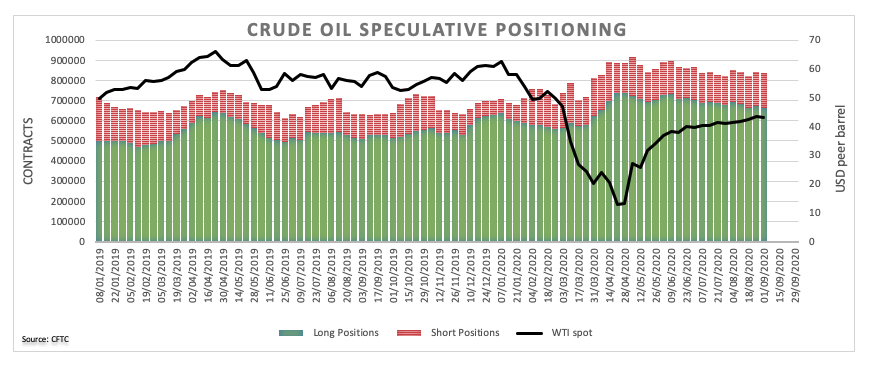

News from the speculative community showed crude oil net longs dropped to the lowest level since early April during the week ended on September 1, as per the latest CFTC Positioning Report.

Later in the week, the API’s report on US crude oil stockpiles is due on Wednesday ahead of the EIA’s report on Thursday and the weekly oil rig count by driller Baker Hughes on Friday.

WTI significant levels

At the moment the barrel of WTI is losing 4.86% at $37.16 and a breach of $36.32 (100-day SMA) would aim for $34.38 (low Jun.15) and finally $30.73 (low May 22). On the upside, the next resistance is located at $43.75 (monthly high Aug.26) seconded by $48.64 (monthly high Mar.3) and then $54.45 (monthly high Feb.20).