- Prices of WTI remains on the defensive albeit off lows.

- Global slowdown keeps weighing on crude oil.

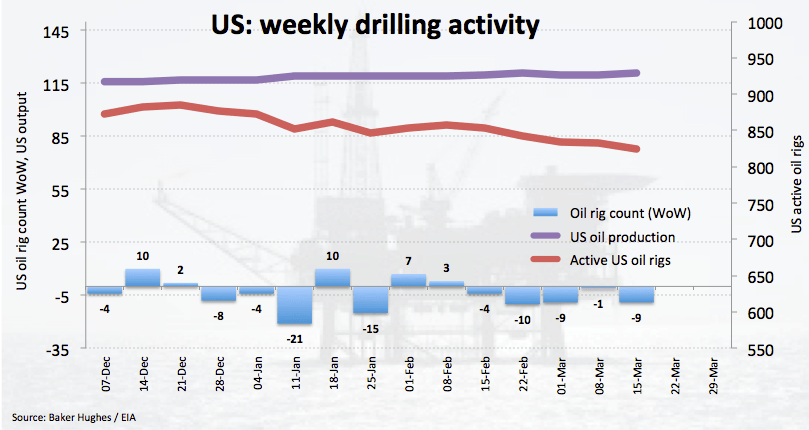

- US oil rig count dropped by 9 during last week.

Prices of the barrel of the American benchmark for the sweet light crude oil are extending the leg lower although finding quite strong contention in the $58.00 region.

WTI weaker on growth fears

The barrel of WTI keeps correcting lower on the back of persistent concerns over a global slowdown and its impact on the demand for crude oil and with China, the EU and the US in the centre of the debate.

In this regard, latest PMIs figures in Euroland and the US point to some weakness in these economies, which have also added to the view of a slow pace of growth in the Chinese economy. In addition, declining US yields and the inversion of the curve also collaborates with the sour sentiment.

Somewhat supporting prices, driller Baker Hughes reported its fifth consecutive weekly drop in oil rig count, taking US active oil rigs to 824 (from 873 seen at the beginning of the year).

Later in the week, markets’ focus will be on the usual reports by the API (Tuesday) and the EIA (Wednesday) on crude oil inventories.

What to look for around WTI

Crude oil has managed to retake the critical $60.00 mark per barrel on Thursday before sparking a correction lower. In spite of the ongoing correction in prices, the bullish view in crude oil remains well in place, always propped up by the so-called ‘Saudi put’, tight conditions in the US markets (amidst US net imports in historic low levels and the rising activity in refiners ahead of the summer session), the current OPEC+ agreement to cut oil output and ongoing US sanctions against Iranian and Venezuelan crude oil exports. Furthermore, the OPEC+ could announce an extension of the current agreement to curb oil production at the cartel’s meeting in June.

WTI significant levels

At the moment the barrel of WTI is losing 0.20% at $58.55 and faces immediate contention at $57.98 (low Mar.22) seconded by $57.31 (21-day SMA) and finally $54.37 (low Mar.8). On the other hand, a breakout of $60.03 (2019 high Mar.21) would open the door for $61.76 (200-day SMA) and then $63.74 (61.8% Fibo of the October-December drop).