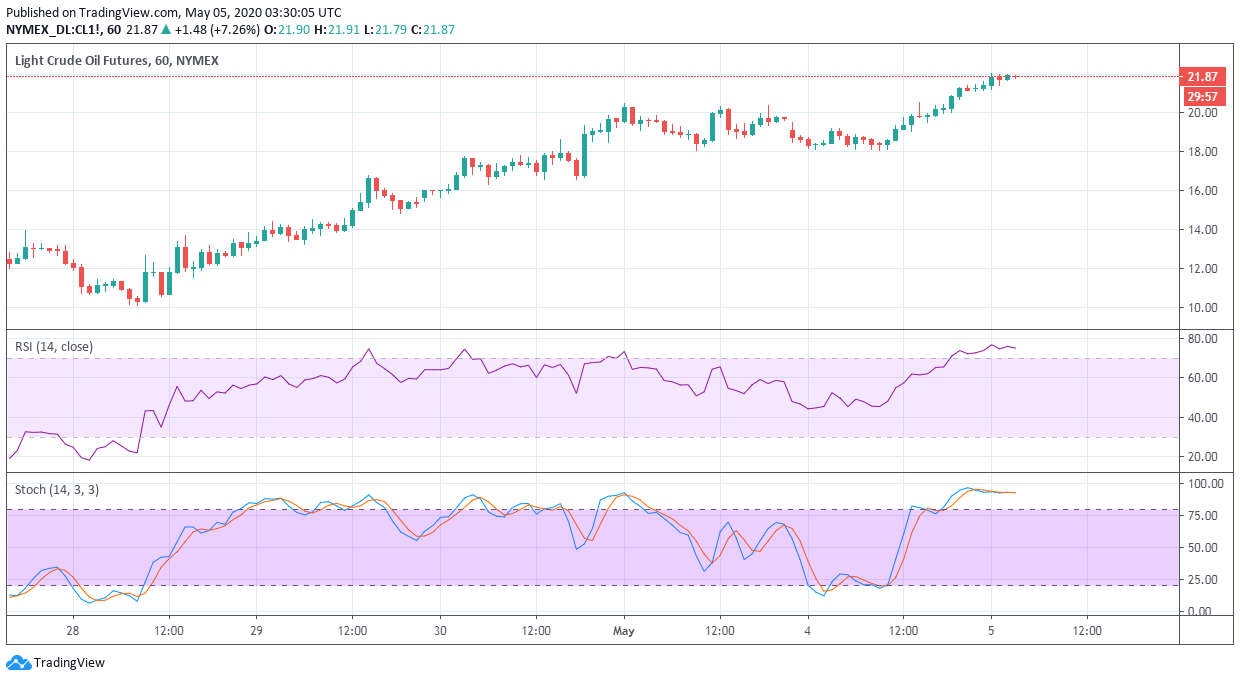

- WTI struggles to keep gains above $22.

- The hourly chart shows overbought readings on key indicators.

- A price pullback looks likely.

The bullish move in the West Texas Intermediate (WTI) crude looks to have stalled during Tuesday’s Asian trading hours.

The black gold is currently trading near $21.83 per barrel, representing a more than 7.5% gain on the day. The hourly chart shows the previous three candles failed to keep gains above the psychological hurdle of $22.

The bull failure validates the overbought reading on the 14-hour relative strength index and the stochastic indicator. As a result, prices may pullback to $21 over the next few hours. A violation there would shift the focus to the hourly chart horizontal support at $20.48.

Altneratively, a daily close above $22 would mark an upside break of the trendline falling from March 11 and April 9 highs. That would expose the hurdle at $29.13 (April 3 high).

Hourly chart

Trend: Neutral

Technical levels